Gold: Secret Fort Knox plans and rise to $20,000?

Gold continues to flow from London to New York. Fear of tariffs? For many, this is just a pretext. There are plenty of theories about what is currently going on in the gold market. Much of it is dismissed by the mainstream as a conspiracy theory. But is it really? A few thoughts on the most common theories, assumptions and rumors.

1. The gold in Fort Knox is gone and banks are now moving gold from London to New York to replenish stocks before a possible audit.

What speaks for it? The stocks in Fort Knox were last subjected to a thorough inspection in the early 1970s. Since then, there have been two random visits, but these have been anything but transparent. If all the gold is still there, why is it being made such a secret? Governors have allegedly also prohibited inspections. This fuels the suspicion that something is being kept secret here. Was the gold lent out and did banks speculate with it for many years?

What speaks against it? The gold bars have numbers that are recorded in a directory. Even if bars were delivered now, they would not be the bars that were actually supposed to be stored. This would raise questions during a truly independent audit. In addition, the relocation began immediately after Donald Trump's election. However, Donald Trump was elected president for the first time in 2016. There were no such transports back then. So how did the market know immediately after the election that there might be an audit this time, but not when Donald Trump was first elected? In addition, silver and copper were also moved from London to New York. But that can't have anything to do with Fort Knox.

Opinion: There seems to be more to the gold transfers than just fear of tariffs imposed by Donald Trump. But whether the gold is really missing from Fort Knox or whether the banks are simply afraid of delivery obligations that they would otherwise not be able to fulfill is another matter. The fact that the whole thing is now taking place shortly before a potential audit is of course fueling the theories. But let's be honest: If the banks are deliberately given time to make up for potential shortages in Fort Knox, then it will most likely never be known.

2. The US could partially back its currency with gold.

What speaks for it? More and more countries are turning away from the petrodollar in new contracts. The rise in the price of gold, but also the rise of Bitcoin, are also signs that a certain distrust of fiat currencies in general and the dollar in particular is growing. China has been buying gold for years and its stocks are growing. If the USA were to partially back the dollar with gold, this would increase the credibility of the dollar immensely and the dollar's dominance would probably be secured again for the time being.

What speaks against it? A lot! Even if the USA only wanted to back part of the dollar with gold, gold would have to be priced much higher. In this context, you often hear that the USA would simply fix the gold price at a high rate, for example 20,000 dollars per ounce. But the times when the gold price was primarily determined by the USA are over. There are also important trading centers outside the USA. London and Shanghai, for example. But gold is also becoming more and more valued in the Emirates. Simply bypassing these markets and fixing the gold price is unlikely to be possible. In addition, the past few years have shown that central banks must remain flexible. A partially backed currency would partially deprive them of this flexibility.

Opinion: It is unlikely that the US really wants to back the dollar with gold. This would hardly be feasible in practice.

3. The USA could back government bonds with gold in the future.

What speaks for it? The USA is in a debt trap. Annual interest payments now total more than a trillion dollars. A bond backed by gold could mean greater security and significantly reduce the interest rate. That would be a good thing for the USA.

What speaks against it? Apart from the fact that the whole thing would be difficult to implement in practice, the question is what message such a backing of government bonds with gold would send. Ultimately, investors would ask themselves why the USA is doing this, whether the risk of default is not higher than expected. And there is another major reason that speaks against it: if newly issued bonds were backed with gold, what would happen to the yield (and conversely, of course, to the bond price) of government bonds already in circulation? Such a step could kill the bond market. And that would certainly not be in the USA's interest.

Opinion: Technically difficult to implement and fraught with numerous pitfalls, it is very unlikely that the US would consider such a step.

Of course, one could philosophize and discuss these topics for a long time. And the pros and cons discussed here make no claim to completeness. One thing is certain: the gold market is on the move. The shifts from London to New York are likely to have other reasons than just fear of tariffs. Fort Knox remains a secret and a truly transparent, independent audit would be desirable. But who really has an interest in this?

This text already appeared today in the Gold Telegram. You can register for the Gold Telegram free of charge here:

Stay up to date with gold, silver and mining stocks. Subscribe to the Gold Telegram – free and without obligation. Receive the assessment of our gold expert Markus Bußler once a week.

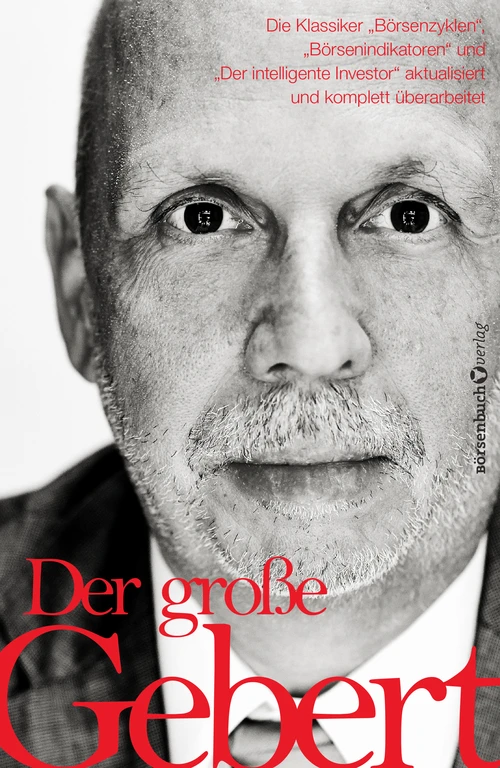

"The Intelligent Investor", "Stock Market Indicators" and "Stock Market Cycles" are classics of stock market literature. Their author is the physicist Thomas Gebert, who has been extremely successful on the stock market for many decades and whose "Gebert Stock Market Indicator" has impressed experts for years with its simplicity and outperformance. Thomas Gebert has now completely revised his three bestsellers, adapted them to the current situation and added current examples. "The Great Gebert" is concentrated stock market knowledge that gives the reader instructions on how to act objectively, calmly and extremely successfully on the markets.

deraktionaer.de