Insurers discover private markets: demand for unit-linked policies with alternative investments is growing

German life insurers' interest in private markets policies is increasing significantly. This is the result of a recent survey conducted by BNP Paribas among unit-linked life insurance providers. According to the survey, around half of the companies surveyed plan to offer policies with investments in private equity, private debt, or infrastructure in the future.

The central motive for this trend is the search for alternatives to traditional investments such as stocks and bonds. Eight out of eleven insurers surveyed see the low correlation with traditional markets and lower volatility as significant advantages of alternative investments for retirement planning. The majority also consider the return potential to be attractive.

Private equity remains the first choice among private marketsPrivate equity dominates the selection of asset classes. Nine out of eleven respondents consider investments in unlisted companies to be particularly relevant, followed by six mentions each for private debt and infrastructure. "In the current situation, it is important to examine the impact of the increased interest rate environment on the sometimes heavily leveraged capitalization of target investments," says Christian Eck, Head of Insurance Equities at BNP Paribas Corporate & Institutional Banking Germany. "However, in many cases, capitalization structures have already been adapted to the new market environment."

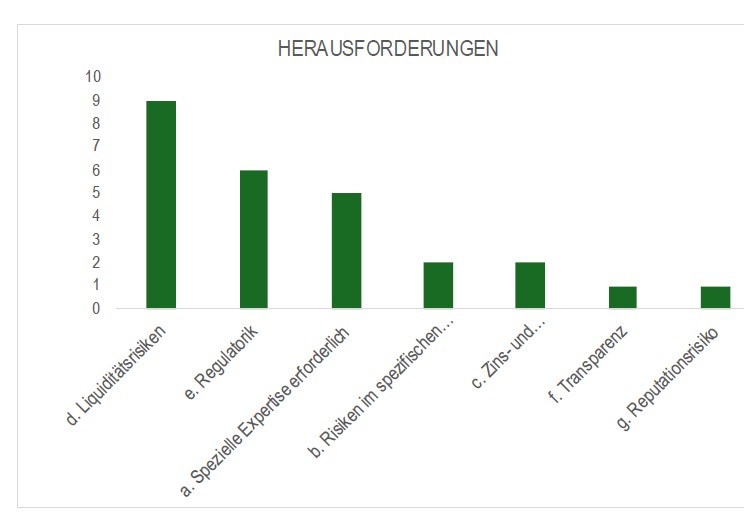

At the same time, however, significant challenges remain from the perspective of product providers. The surveyed providers cited liquidity risk as the most important issue. Since private markets typically only provide liquidity quarterly, new ideas are required when structuring fund-linked products. Regulatory uncertainties and the high demand for specialized investment expertise are also cited as key hurdles.

Chart: Biggest challenges in using private equity policies

Another issue remains the cost structure. The majority of respondents rate the ongoing costs of current offerings as moderate to high. In a competitive environment, it will be crucial to keep total costs at a level that allows policyholders to achieve attractive returns despite the challenging capital market situation.

Despite the challenges mentioned, the survey shows that the market for private markets policies is still in its infancy, but offers considerable growth potential. Insurers expect this not only to offer better returns for their customers, but also to provide greater competitive differentiation.

The BNP Paribas survey is based on feedback from eleven providers of unit-linked life insurance solutions, which together cover almost half (approximately 45 percent) of the German market.

private-banking-magazin