Klarna: IPO price surprises — this is what one share costs

Swedish payment provider Klarna set the issue price for its shares on Tuesday . At $40 per share, the offering price is surprisingly above the originally targeted range of $35 to $37. The IPO, which will be completed today on the New York Stock Exchange, will value the company at approximately $15 billion.

Under the slogan "Buy now, pay later," Klarna enables consumers to pay for purchases from selected online retailers at a later date. Unlike traditional purchase on account, which typically has a 14-day payment period, Klarna allows customers to defer payment for 30 or even 60 days for a small fee.

This business model is particularly popular among young adults – but it also has a downside: many of them have already gotten into massive debt as a result.

No profits in sightKlarna raised a total of $1.37 billion through its IPO. However, only $200 million of this will go into the company's coffers, while the majority—approximately $1.17 billion—will benefit existing shareholders who are reducing their holdings.

Operationally, however, the picture is mixed: In the second quarter, Klarna reported a net loss of $53 million – compared to a loss of $18 million in the previous year. However, revenue increased significantly by 20 percent to $823 million. It is currently uncertain when the company will become profitable.

More than just "Buy now, pay later"To generate additional revenue, the company is currently trying to broaden its footprint and increasingly position itself as a digital retail bank. In addition to its "buy now, pay later" business, the company earns from merchant fees, interest on longer-term loans, and late payment penalties.

Klarna shares are starting trading with strong momentum. Find out whether the stock is a buy or not in the new issue of AKTIONÄR, which will be published here today at 7 p.m.

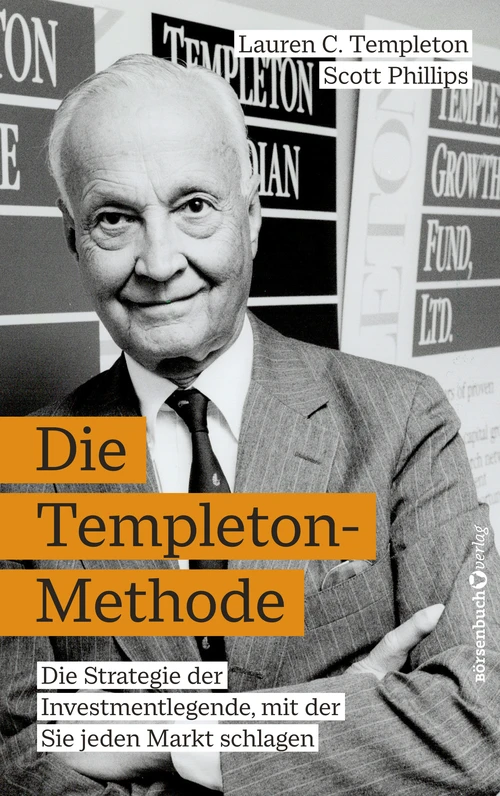

Legendary fund manager Sir John Templeton is considered one of the pioneers in the field of value investing, consistently outperforming the market for five decades. After reading this book, readers will gain a completely new perspective on Sir John Templeton's timeless principles and methods. They will be introduced step by step to the stock market professional's proven investment strategies. They will learn the methods Templeton used to select his investments and, with numerous past examples, gain insight into Sir John's approach and his most successful trades. In these volatile times, investors can now more than ever incorporate Templeton's ideas into their own strategies and thus operate profitably in the financial markets.

deraktionaer.de