Nvidia becomes the first company to surpass $4 trillion in market capitalization on Wall Street.

Semiconductor giant Nvidia on Wednesday became the first US company to surpass the psychological barrier of $4 trillion in market capitalization, driven by the rise of artificial intelligence (AI).

Nvidia shares rose 2.64% on the New York Stock Exchange to $164.07.

"Nvidia is the strongest stock in the market right now," said Adam Sarhan of 50 Park Investments.

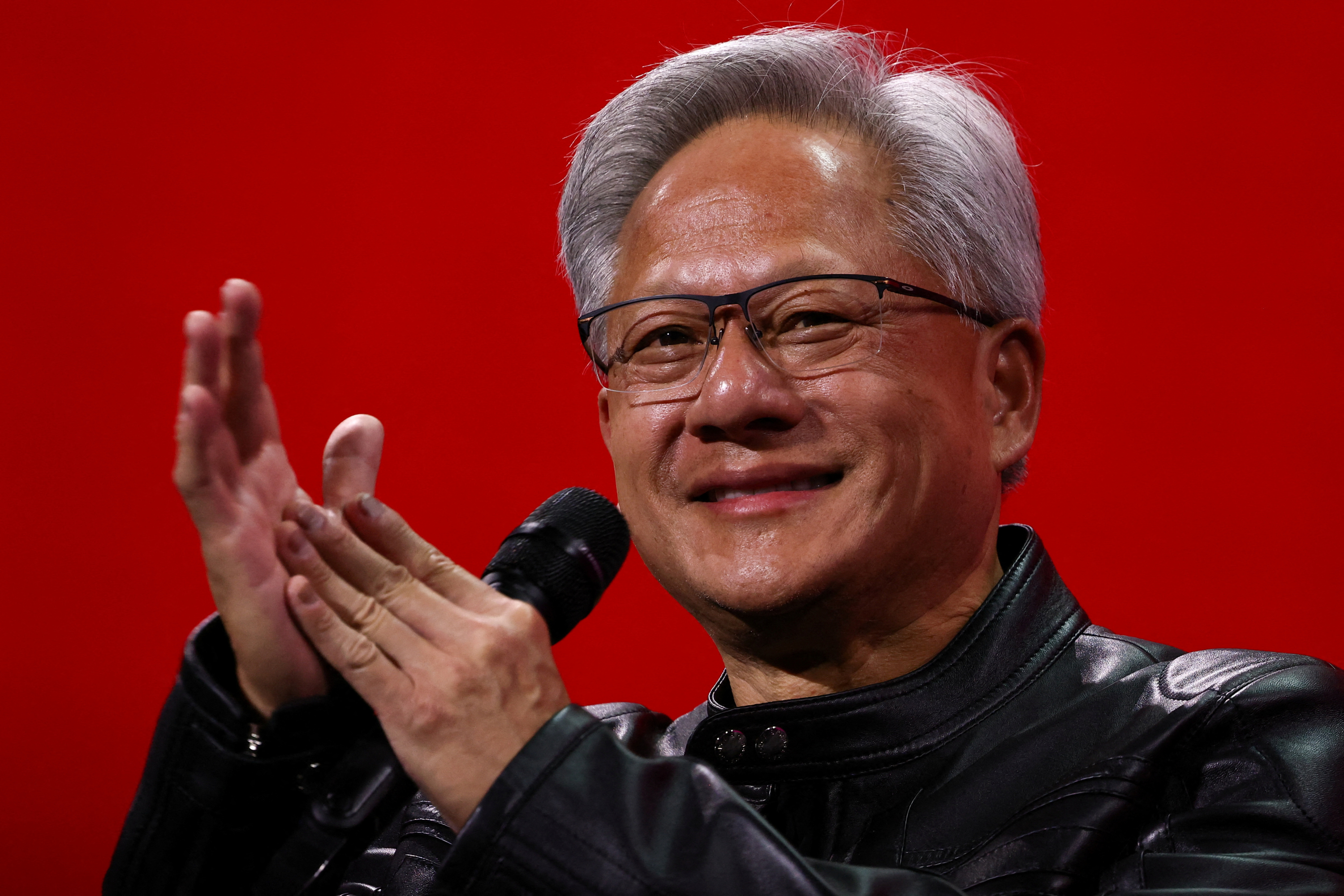

Nvidia CEO Jensen Huang, Photo: AFP

"The market is a reflection of the economy. And the strongest sectors of the economy are, by far, technology and artificial intelligence. That's why Nvidia is worth so much and continues to grow," the analyst noted.

Nvidia, led by electrical engineer Jensen Huang, has a market capitalization of $4 trillion, larger than the gross domestic product of France, the United Kingdom, or India.

The market is a reflection of the economy. And the strongest sectors of the economy are, by far, technology and artificial intelligence.

This new milestone demonstrates investor confidence that AI will drive a new era of robotics and automation, boosting productivity and challenging traditional industries.

The Californian company's recent growth is driving the recovery of the stock market in general.

Nvidia shares rose 2.64% on the New York Stock Exchange. Photo: Getty Images

This is partly due to the relief generated by the withdrawal of President Donald Trump's most drastic tariffs, which battered global markets in early April.

Despite Trump announcing new tariff measures in recent days, the S&P 500 and Nasdaq have remained near record highs. "We've seen the markets support us in the worst-case scenario regarding tariffs," said Angelo Zino, technology analyst at CFRA Research.

While Nvidia still faces US export controls to China, the company's deal to build AI infrastructure in Saudi Arabia during a state visit by Trump in May showed that the US president's trade policy also had upside potential.

"We've seen management use Nvidia chips as a bargaining chip," Zino added.

Nvidia's recent surge to $4 billion marks a new milestone. Photo: Nvidia

Nvidia's recent surge to $4 billion marks a new milestone in a sustained climb over the past two years as enthusiasm for AI grows.

So far in 2025, the company's stock has risen more than 20%, while the technology-heavy Nasdaq index has seen more limited growth, of more than 6%.

In the latest quarter, Nvidia reported profits of nearly $19 billion despite a $4.5 billion hit from U.S. export controls designed to limit sales of cutting-edge technology to China.

The first-quarter earnings report also revealed that AI momentum remained strong across the tech industry.

Many of the largest technology companies, such as Microsoft, Google, Amazon, and Meta, are competing against each other in the race to win the AI race.

A recent UBS survey of technology executives showed that Nvidia is widening its lead over its rivals.

Nvidia is at the forefront of "AI agents," the current approach to generative AI, in which machines are capable of reasoning and inferring more than before, Zino said. "Overall, the demand outlook has improved by 2026 for these more complex reasoning models," he concluded.

eltiempo