The most common mistakes when filing your income tax return in Colombia: expert advice to avoid DIAN penalties in 2025

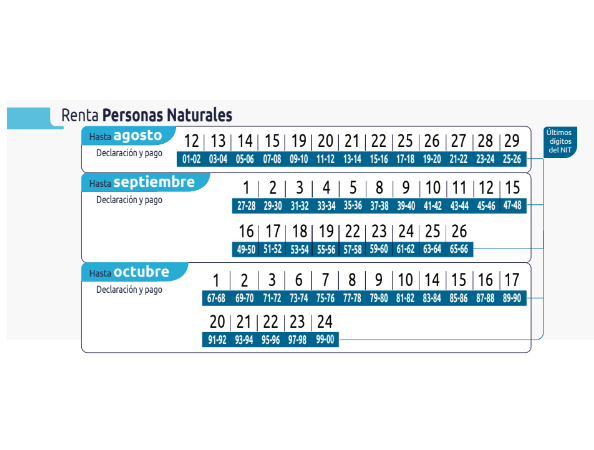

The tax calendar for individuals who must file their income tax return with the National Tax and Customs Directorate (DIAN) will begin on August 12th. This is a document through which individuals who meet certain requirements must report their income, expenses, and assets, which will determine whether or not they must pay income tax.

Despite this being a common procedure, many Colombians still have doubts, leading them to make errors in the procedure and even receive sanctions from the DIAN.

EL TIEMPO spoke with an expert to learn about the most common mistakes made when filing income tax returns, as well as key tips for completing this important process.

Payment and income tax returns are based on the last digit of the individual's National Tax Identification Number (TIN). Photo: iStock

As Tatiana Osorio, a professor at the International School of Economic and Administrative Sciences at the University of La Sabana, explained to this newspaper, for the 2024 tax year (which is declared in 2025), "natural persons must file an income tax return if they meet at least one of the requirements established by the Dian and the Tax Statute."

According to the Dian, the following will be required to file income tax returns in 2025:

- Individuals with gross assets exceeding $211,793,000 (as of December 31, 2024).

- People with total income exceeding $65,891,000. According to Osorio, this includes income from salaries, pensions, fees, rent, or financial returns.

- People whose credit card spending totals more than $65,891,000 in the year.

- Those whose purchases and consumption exceeded $65,891,000 in 2024.

- People whose bank deposits, deposits or financial investments exceeded $65,891,000.

Individuals with gross assets exceeding $211,793,000 must file an income tax return. Photo: iStock

The expert stated that it's important to keep in mind that even if a person didn't exceed these thresholds in 2024, they may still be required to file a tax return if they had withholdings as a self-employed person or non-employment income.

Remember that users of digital wallets like Dale, Nequi, and Daviplata will also be required to file income tax returns if they meet the requirements.

On the contrary, those who "only receive low-wage income and lack significant assets, as well as certain protected groups, such as indigenous people or disability pensioners," will be exempt from this declaration.

What are the most common mistakes Colombians make when filing their income tax returns? Tatiana Osorio explained to EL TIEMPO that one of the most common mistakes when filing income tax returns is omitting income, either due to lack of knowledge or lack of documentation. According to her, many people often forget to declare information such as:

- Sporadic rentals.

- Labor bonuses.

- Bank interest.

- Gains from sale of assets.

As a second mistake, the expert from the University of La Sabana mentions that individuals forget to update their assets, leaving out transactions such as the purchase of a new car or property from their tax returns.

Many Colombians forget to report all their income on their tax returns. Photo: iStock

The problem with not reporting assets correctly, according to experts, is that the declaration calculations are performed incorrectly. This, as Osorio indicated, can raise red flags with the DIAN and lead to sanctions from the entity.

Another common mistake, Osorio explains, has to do with the handling of deductions, benefits that the Statute provides to help taxpayers "reduce their tax burden."

"The mistake lies in mishandling deductions. For example, including unauthorized expenses, such as children's school tuition or personal expenses, or exceeding the legal limits for healthcare, pensions, or mortgage interest," he indicated.

Among the most common taxpayer errors are forgetting and failing to comply with the deadlines established by the DIAN (National Tax Agency), which carries a penalty of 5 percent of the tax for each month of delay, as well as failing to update the Single Tax Registry (RUT) before filing, which can cause delays in the process.

Failure to comply with the deadlines established by the Dian carries a penalty. Photo: iStock

Given this situation, the professor from the International School of Economic and Administrative Sciences at the University of La Sabana offered a series of recommendations for filing the tax return correctly:

- Organize your income tax return in advance according to the dates established by the DIAN.

- Gather all the necessary documents for filing, including income and withholding certificates, as well as bank statements and invoices for deductible expenses (such as health, pensions, or donations).

- Check the valid deductions in the Tax Code. "Not all expenses are acceptable, and some, such as donations, only apply if they are to authorized entities," Osorio explained.

- Keep the supporting documents you use for your tax returns for at least five years. According to the teacher, the DIAN can audit past tax returns.

- If you have any questions, consult the DIAN helpline or consult an accountant, especially if the case is complex.

- The expert also recommends declaring assets held abroad. This is because "the DIAN is increasingly focused on controlling these resources."

Individuals will have August, September, and October to file their tax returns and pay. Photo: Diego Caucayo/EL TIEMPO Archive

Osorio explained that whether or not an accountant is necessary for tax returns will depend on each case. For example, a salaried taxpayer with a single job and no major deductions could complete the process using the tools implemented by the DIAN.

On the contrary, with more complex profiles, the work of an accountant can save you a lot of headaches. "If the person has multiple sources of income (salary, fees, rent), property sales or investments, or deductible expenses such as mortgage interest or donations, it's ideal to have an accountant," he said.

He added: "A professional not only avoids errors that can lead to fines, but also helps optimize tax burdens, ensuring that legal benefits are fully utilized."

The help of an accountant can save you headaches. Photo: iStock

The DIAN's tax calendar for individual income tax returns will begin on August 12 and run through October 24, 2025.

Please note that dates are determined by the last digit of the NIT.

These are the dates for individual income tax returns. Photo: Screenshot by Dian

ANGIE NATALY RUIZ HURTADO

LATEST NEWS EDITORIAL

eltiempo