If Milan pushes away those who live in rented accommodation it is (also) because it supports a system called AirBnb

Milan thrives on transformation . It has always been this way, ever since the Visconti family decided to make their city a crossroads of commerce and ambition. Until a decade ago, the Lombardy capital was merely Italy's economic capital , but since the 2015 Expo put the city in the international spotlight, it has convinced itself it can also be a tourist hub (or have the potential to become one). Short-term rentals have emerged as a natural, almost inevitable consequence.

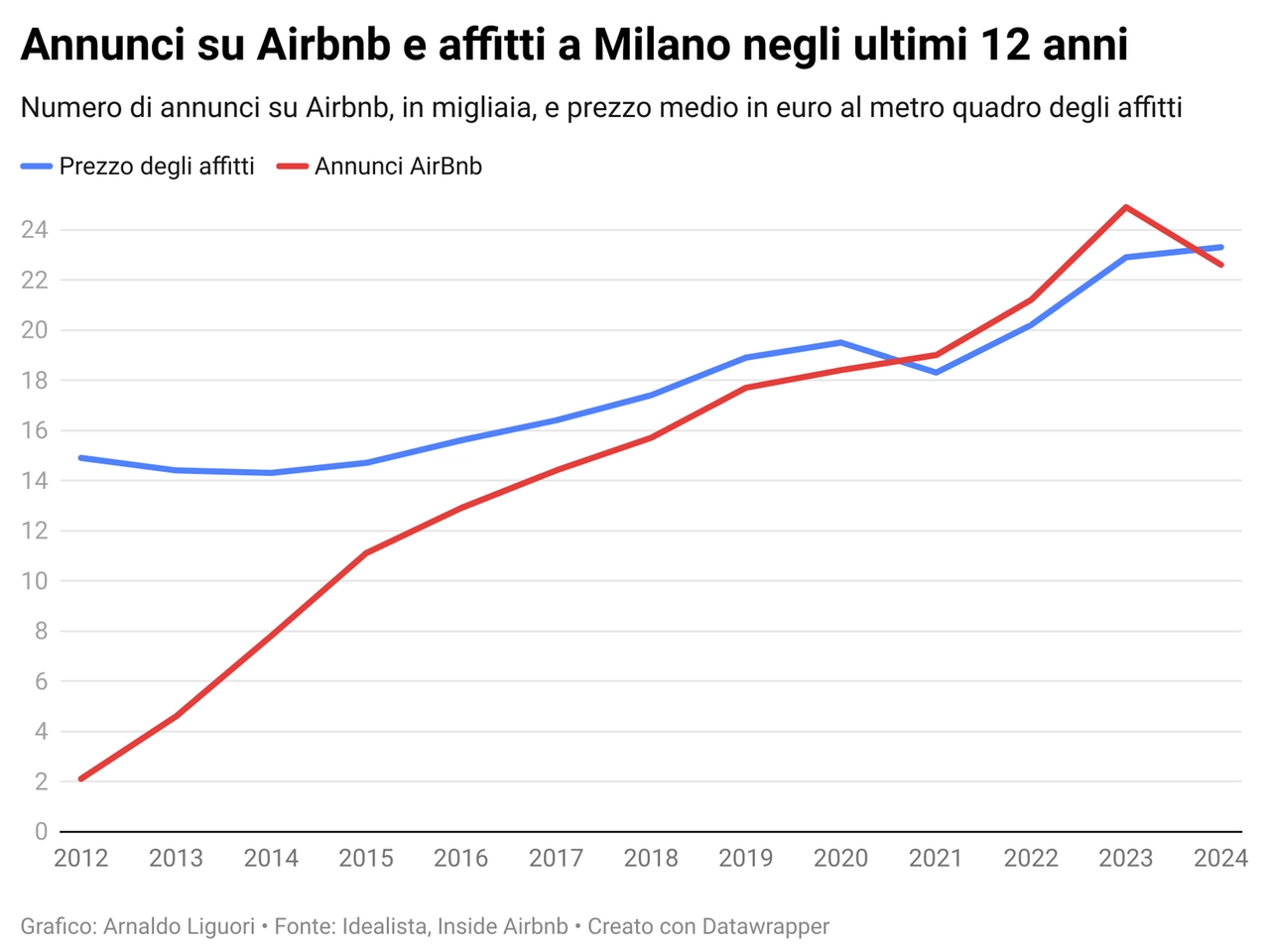

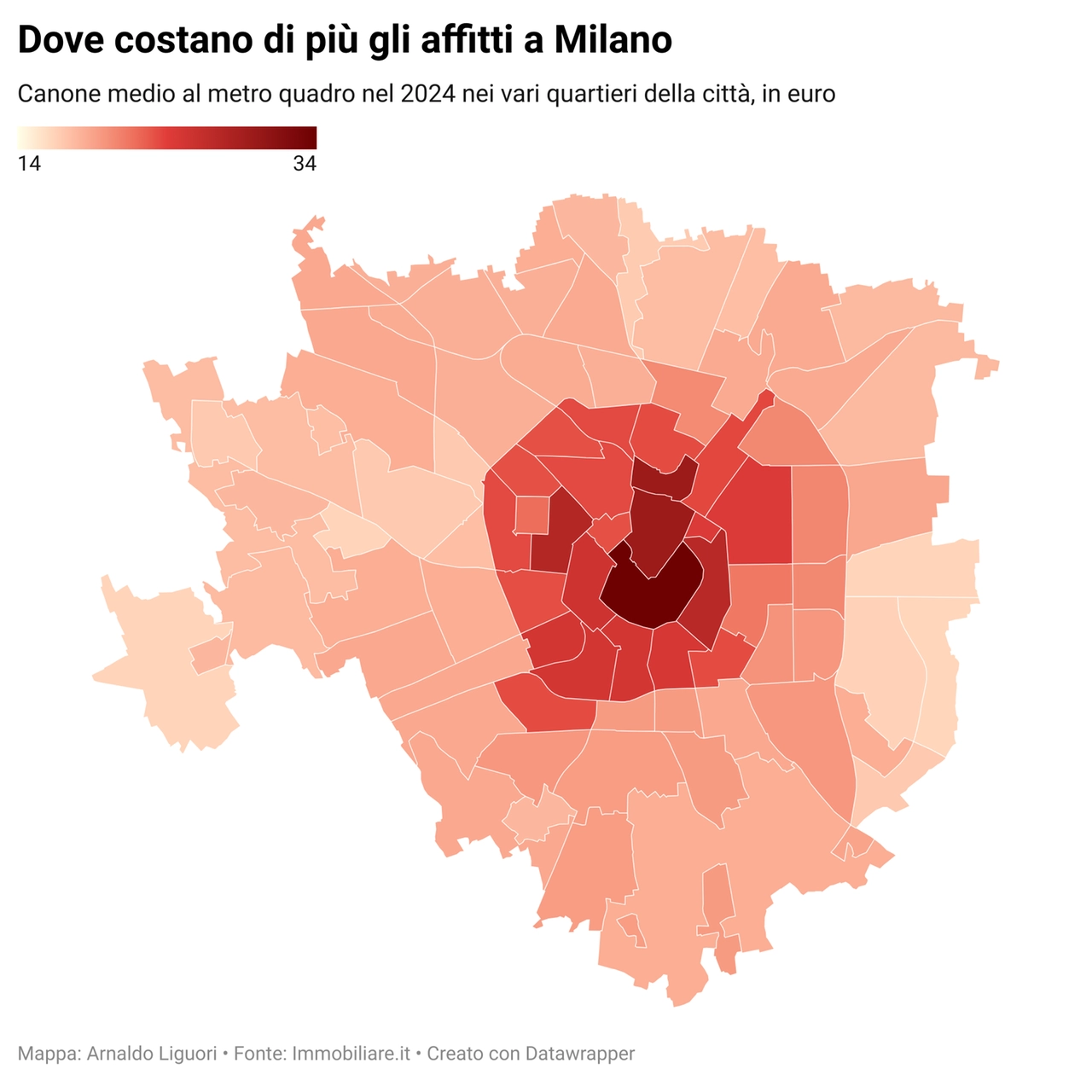

In 2018, there were already 17,700 listings on Airbnb , and by 2024, they had reached over 22,600 ( Inside Airbnb data ). Over the same period, the average rent in the city rose from 17.4 to 23.3 euros per square meter ( a nominal increase of 34% ). These two phenomena—as is happening in other Italian and European cities—are linked: short-term rentals can compress the supply of housing , putting pressure on the market and pushing up prices. But the question is: to what extent is this happening in Milan?

In general, according to the authoritative research center Tortuga , a 1% increase in Airbnb penetration (i.e. the percentage of homes put online compared to those available for rent) corresponds to a 6.7% increase in home purchase prices and a 5.7% increase in rental prices .

This estimate, however, is based on national calculations, while each city is unique. Determining the extent to which these numbers apply to Milan is very difficult, but a clue can be obtained by comparing the number of listings published on Airbnb from 2012 to today with the average rental price in the city during the same period. As can be seen from the graph, the trend is similar.

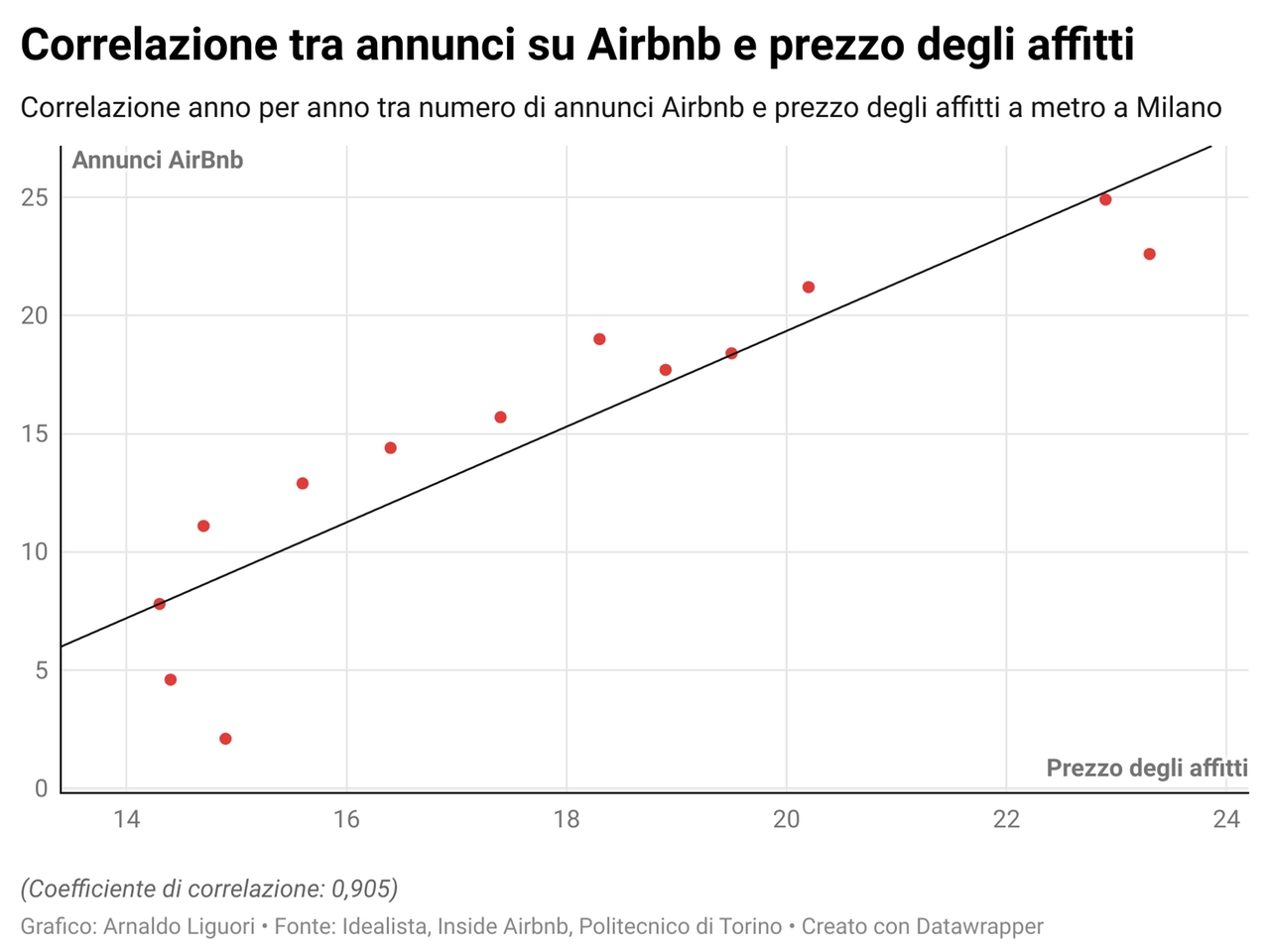

Specifically, there's a number—called the Pearson index —that measures how closely two phenomena "move" together. A value close to 1 indicates a perfect correlation between the two phenomena, while a value close to 0 reveals no obvious connection. Comparing Airbnb listings and rental prices over the same period, year by year, the result is 0.9 : a clear correlation (the correlation is shown below in graphical form).

Of course, the existence of a correlation doesn't mean there's causality (one may not cause the other). However, several studies that have found the same correlation conducted in recent years have hypothesized a cause-effect relationship. A large study funded by the European Commission to assess the situation in Rome, Milan, and Paris found that "regarding house prices, we find a significant positive correlation between the presence of short-term rental accommodation (Airbnb) and house prices in Milan and Rome." This impact, according to the research, is especially significant for medium-sized homes and in central areas of the city .

The research concludes by reiterating that it is necessary to further investigate "whether there is a causal relationship between the increase in house prices and the expansion of Airbnb listings" and argues that "short-term rentals, if not sufficiently regulated, could lead to a progressive disintegration of the social fabric ."

Another study by Bicocca University , using Irept data, states that “the current penetration rate of the short-term rental market in Milan shows elasticities that translate into rental price increases of 5-7% across the city , while high-tourism neighborhoods record even greater impacts”.

The Navigli district, for example, shows one of the highest concentrations of short-term rentals, equal to 12% of the total housing units : here, rents increased by 42% from 2015 to 2023 (compared to an average increase in the city of 28%).

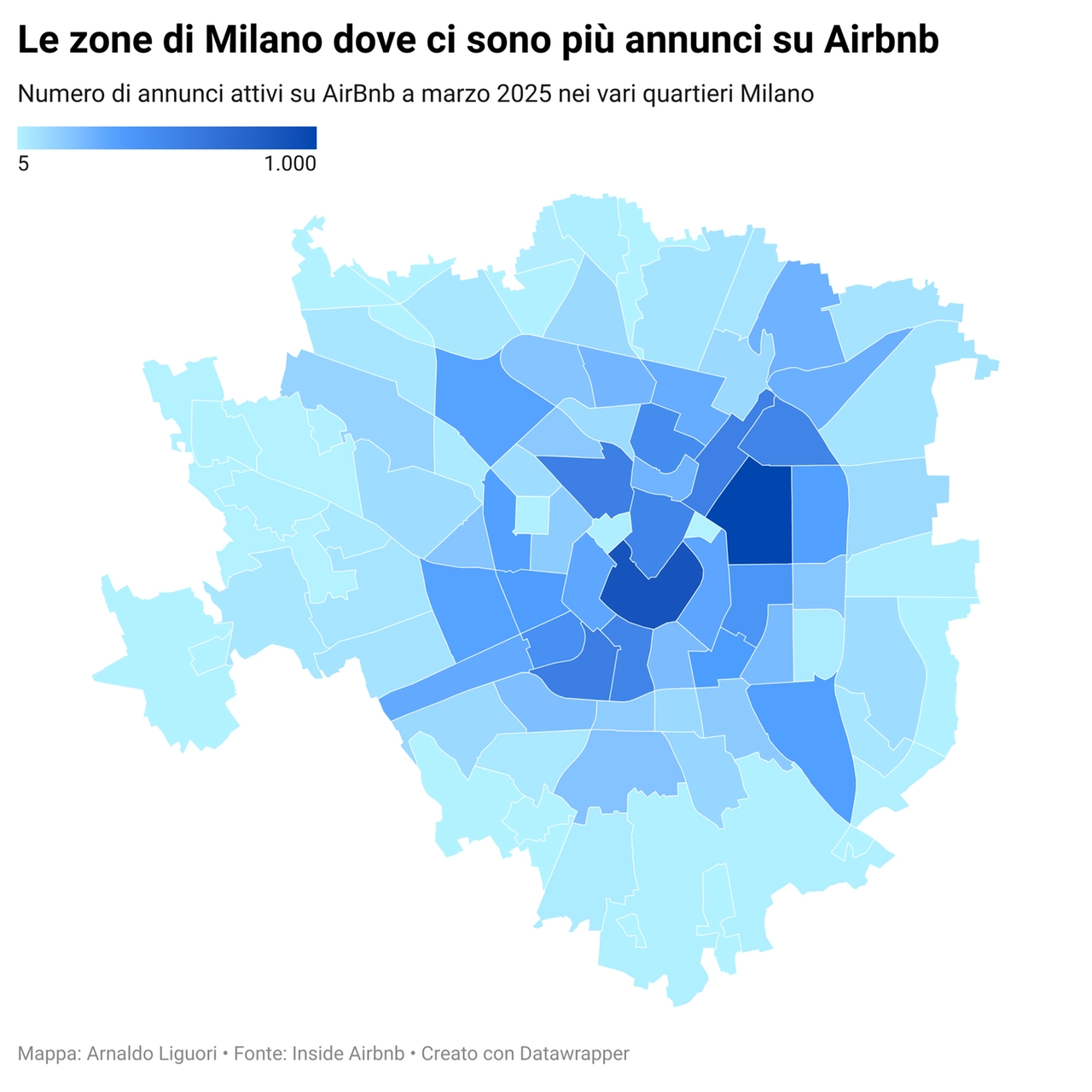

In Milan, most of the short-term rental offerings are concentrated in the inner city areas , with strong penetration in the areas surrounding the station. The areas with the most listings, in addition to the Center , are Buenos Aires , Centrale , Porta Ticinese , Brera , Sarpi , Loreto , Navigli , and Isola . These areas have some of the highest rents in the city .

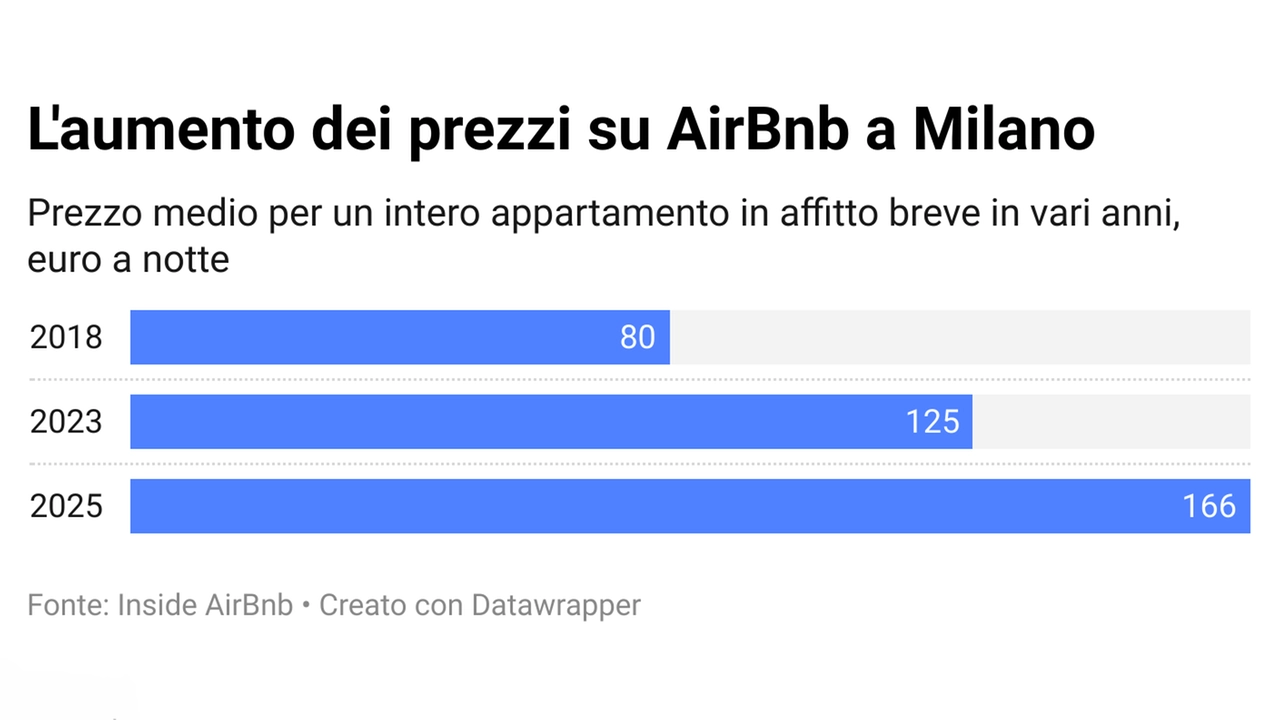

But the issue isn't just about prices: short-term rentals are transforming the city in ways that go far beyond the simple dynamics of supply and demand. The Airbnb market is increasingly attractive: in just over ten years, the average cost of renting an apartment for vacations or business trips has risen from €80 to €166 per night (with significant increases in the run-up to the 2026 Milan-Cortina Olympics ).

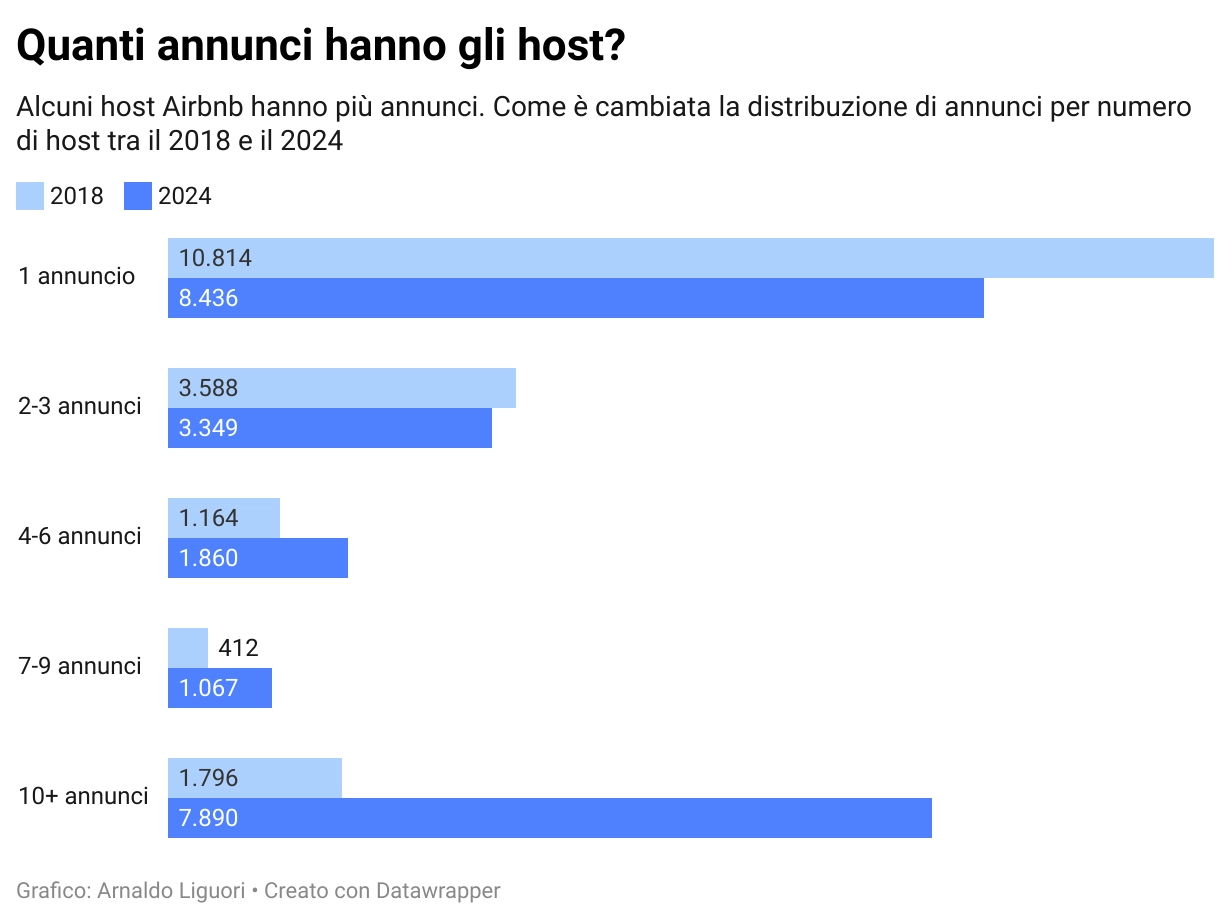

This has led to a rush to Airbnb . While in the past, managing apartments listed on the platform was largely a private matter between owners and guests, it has now become a tourism business . And in recent years, this trend has become increasingly pronounced. In 2018, only 39% of listings were managed by hosts with more than one property : in 2024, that percentage rose to 63% . In other words, everything is increasingly centralized, and there are now agencies or startups managing hundreds of apartments.

Today, the ten largest hosts in Milan are Italianway (managing 480 listings), Donato (345), Cleanbon House (305), Simone (202), Chiara & Roberto (138) – they use their own names, but in fact they are agencies. And also: I-Host (136), Andrea (135), Youhosty (128) and Habyt (127) and Its Home (119).

In short, these aren't private homeowners putting their second apartment (perhaps inherited) online. They're companies specializing in short-term rentals . Their model is simple: they manage the owners' apartments, take care of everything (cleaning, check-in, guest relations), and in exchange guarantee a fixed monthly income, or a percentage , to the owner. For many owners, it's a great deal: no tenants to manage, no strings attached, no four-year contracts renewable for another four, none of the complications of agreed-upon rents or social housing. If they decide to buy their home back one day, they can do so whenever they want.

The point is that this way, the management of thousands of apartments ends up in the hands of just a few companies . And such a concentration has two important consequences . First, these companies can heavily influence real estate market prices. Second, from a regulatory standpoint, everything becomes more complicated, because there's an additional intermediary between Airbnb and the renter. And this makes any attempt at regulation much more difficult .

Of course, a huge number of factors influence the real estate market. The growing presence of Airbnb only partially influences rent increases: rents are influenced by local economic growth , increased demand for housing for work, international real estate investments , (alleged) real estate speculation , and more.

But an impact does exist. And the result of all this is that Milan today faces a choice. On one hand, there's the tourist attraction , which brings in money and international visibility. On the other, there's the livability for those who actually live here , for those who study or work here and have to pay more than €1,200 for a room in the Loreto area or Bocconi .

It's a classic situation where everyone has legitimate interests : the owners who maximize profits, the tourists who find comfortable accommodations, the agencies who build million-dollar businesses. But the price is often paid by those Milanese who can no longer afford to live in their city . This isn't a new story; this has already happened in Barcelona, Amsterdam, and Lisbon: these cities have had to fight to preserve their popular soul , and they haven't always succeeded. The question is: will Milan do things differently, or will it repeat the same mistakes?

Il Giorno