The Government is concerned that the economic recovery will not reflect provincial revenue.

The official explained that, while this year saw a 2.6% increase in shareable resources from January to May, the comparison is misleading because it was a "poor base year." In the same period last year, the provinces received no income tax revenue, resulting in a 7.5% drop compared to 2023.

“So, to recover from a 7.5% drop, you have to grow 10%. That is, for 2025 to be the same as 2023, you have to grow 10% in 2025. This year, we expected to grow 5%, which is what the economy will grow, and we won't reach that level ,” Fayad said.

"When we start comparing ourselves with the not-so-bad part of last year (Editor's note: partial restitution of earnings), that 2.6% won't even reach 5% ," the Finance Minister said.

In concrete terms, in 2024 the Province lost "two payrolls" in co-participation, which today represents $220 billion. " This year we expected to recover a payroll, but we're not going to make it ," the minister lamented.

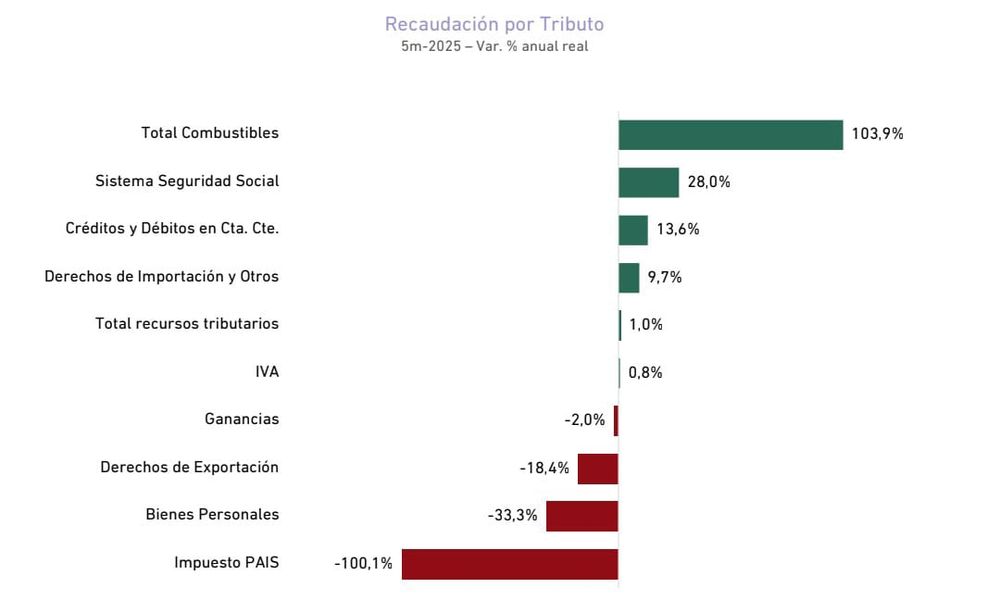

One of the provinces' main demands to the nation is for revenue sharing in liquid fuel taxes. In fact, this is the tax that grew the most this year, while VAT remained flat and income tax declined. In the first five months, fuel revenue exceeded 100%.

WhatsApp Image 2025-06-14 at 16.15.38.jpeg

The government emphasizes that the loss of revenue sharing does not affect all provinces equally, as Mendoza is among the provinces with its own resources, along with Buenos Aires, Córdoba, and Santa Fe , among others. This is unlike other provinces that are highly dependent on national resources, such as El Chaco, Formosa, and Tierra del Fuego.

This also isn't an indication of political or otherwise confrontation with the national government. Fayad explained that "it's not a selfish discussion, about looking at our own bottom line and seeing if we're doing well or not."

“We share many aspects of the country's direction with the national administration. Some we don't, like public works, clearly , but fiscal order and deregulation are things the province has been doing for a long time, and the national government has begun to do so very successfully. Our support is for the plan to work, for Argentina to grow, and for Mendoza to support that growth ,” he said.

Tie in provincial taxesThe government warns that provincial revenue collection is "leveling off in real terms, that is, at zero" compared to the same period in 2024. Minister Fayad noted that tax performance is different, despite the predominance of Gross Revenue.

Without speculating on specific indicators, because the Treasury report is prepared quarterly, the minister admitted that mid-June shows a similar picture to the January-March period.

Gross income shows a 4% decrease (it was -5% in the first quarter). "Of that 4% decrease, 3 points are due to tax policy decisions , that is, reductions in the tax burden, whether in rates or in the tax base. In other words, this is the good news component of the tax drop," Fayad analyzed.

He added that the decline is due to a change in consumer spending , which provides a snapshot of the economic situation. "Before, people used to spend more at supermarkets, local stores, restaurants, and hotels ; now, they're more focused on durable goods," Fayad said.

Regarding the Motor Vehicle Tax , revenue remains "slightly higher" (it was 15% in the first quarter) due to a reduction in late payments. And the Property Tax in particular remains " quite high" (55% at the beginning of the year) due to the addition of 18 million square meters to the tax base.

At the same time, he clarified that the discounts of up to 35% for compliant taxpayers on property taxes , which were recently made official, had already been approved by the Legislature with the tax law. This was a late publication of the respective decree. " No new discounts appeared ," he clarified.

In the case of Stamps , he indicated that "it's been very good because of the increase in credit . Although mortgage contracts and those that go to the productive sector don't, the rest of the financial contracts pay Stamps and it has grown quite a bit."

While royalties continue to decline because the barrel of oil is measured in dollars and there has been a "real appreciation," which, when factored in inflation, "is actually falling," he said.

Conclusions of the TreasuryThus, the overall picture shows a slight decline in Gross Income, as well as in Royalties. While the Property Tax is growing "strongly," Stamp Duty maintains a high percentage, and Motor Vehicle Taxes are growing modestly. "All together, it's a tie against inflation ," Fayad stated.

And then he completed his overall analysis: "This is the year to recover; a draw is a loss. Because we're way down. Last year was very bad, both in the cup and in revenue."

"So, this is a year in which the economy is going to grow , and barring the drop in gross revenue, which is deliberate because we're lowering it, if we don't recover from the cup, this year it's going to be a draw, and we're not going to recover. We lost 3-0 away, and a draw isn't enough ," concluded Minister Fayad.

losandes