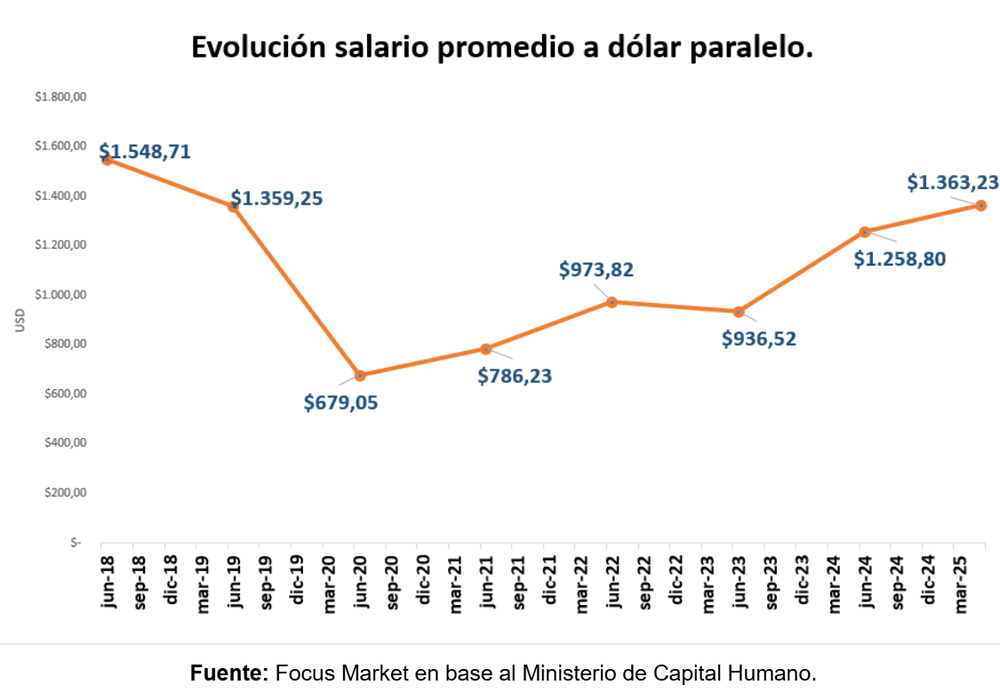

Salary in dollars: a recovery that does not reach the lost level

Although average income measured in blue-chip dollars has improved compared to the 2020 low, it is still far from pre-crisis levels.

In Argentina , speaking of wages in terms of the blue dollar has become an unavoidable reference for measuring real purchasing power in an economy that, although nominally peso-based, thinks in dollars .

According to a report by the consulting firm Focus Market, in June 2018 the average salary was equivalent to US$1,548 (blue), a peak that marked the last breath of the Argentine middle class before the collapse.

Since then, and with an economy plagued by instability, average income plummeted to a historic low in June 2020: just US$679. A figure that reflects the combined impact of the pandemic, exchange controls, and a record exchange rate gap.

image.png

Subsequent developments showed ups and downs. In 2022, the average salary in dollars reached US$973 and a year later fell to US$936. With the change of government in 2024, foreign currency income partially recovered: US$1,258 in April and US$1,363 in May. However, income remains 12% below the 2018 level .

This indicator, increasingly monitored by workers and businesses, reveals an uncomfortable reality: the apparent macroeconomic stabilization is not yet reflected in people's pockets . While inflation slows and the government celebrates its fiscal surplus and accumulation of reserves, formal wages continue to struggle.

Wages and income tax.jpg

Added to this is the official guideline of 1% monthly increases, which lost momentum in the face of inflation that surprised everyone by reaching 3.7% in March. Although prices began to fall, incomes remained flat. Conflict with unions is inevitable: while the Executive branch seeks to prevent wages from driving prices, unions are demanding to recover lost ground.

In the words of economist Damián Di Pace, director of Focus Market: "In this new economic scenario, where inflation is beginning to slow but without a clear recovery in purchasing power, collective bargaining agreements are beginning to play a different role than they have in recent years. Traditionally used as a defense mechanism against rising prices, they now appear strained between their historical function of recovery and the government's new objective: to transform them into an inflationary anchor."

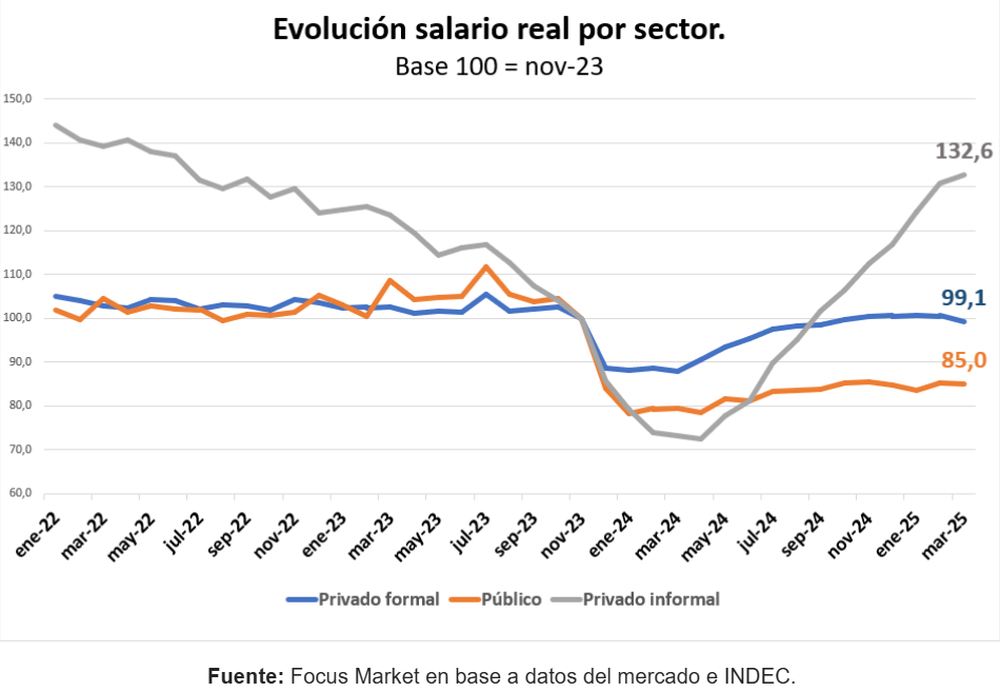

Wages in real termsThe gap is also sectoral: the informal sector showed an improvement in real terms in 2025, partly due to the low starting point in the statistical base. In contrast, state and formal private workers remain behind, having not yet recovered to their November 2023 levels.

image.png

Thus, although some numbers show signs of recovery, the overall picture leaves little room for optimism. The underlying challenge is no longer just about organizing the macroeconomic landscape, but also translating this stability into a concrete increase in income. If the economy as a whole is on track, people's pockets are still waiting.

losandes