Czechs continue to cut interest rates. Credit costs lowest in 3.5 years

There were no surprises and the Czech National Bank at the May meeting meeting decided to reduce interest rates again. The Czechs could afford it because inflation unexpectedly fell in April and again was within the 2 percent target.

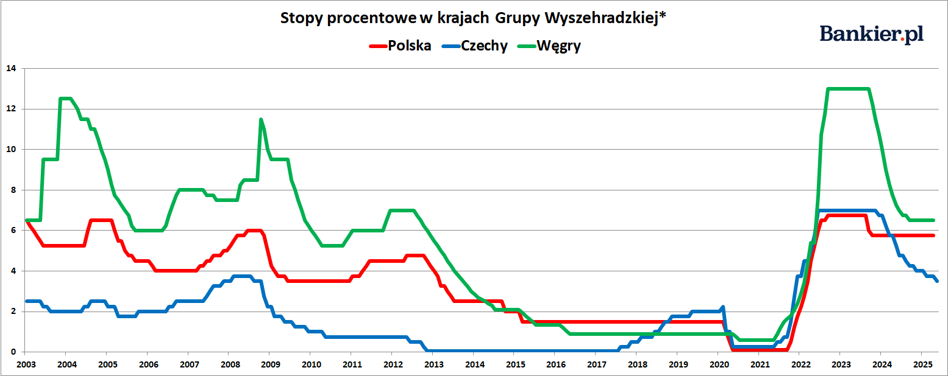

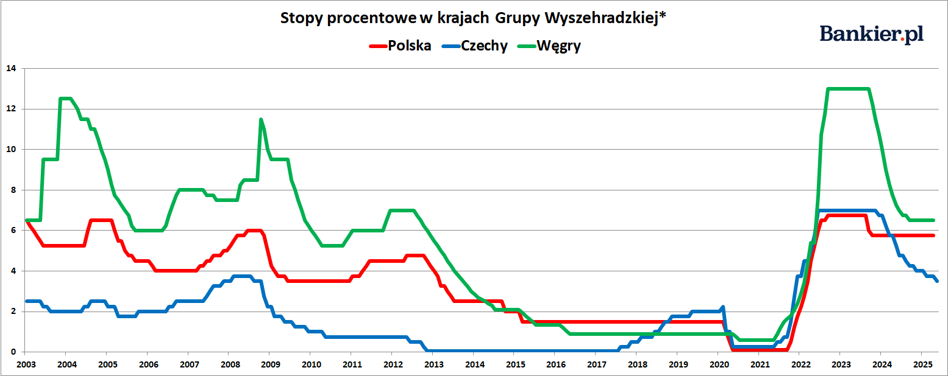

The Council of the Czech National Bank has decided on Wednesday , the interest rate on two-week repo operations will be reduced by 25 basis points to The level of 3.50 percent. This is the second rate cut this year and the tenth cut within the framework cycle started in autumn 2023. As a result, the cost of credit on the Vltava fell to its lowest level since November 2021.

The May decision was in line with economists' expectations. Market consensus assumed a 25 basis point reduction in interest rates , following a 25 basis point cut made in February . However, in March and April the Czechs decided not to reduce prices.

The decision in May was made easier by the recently published CPI inflation data, which quite unexpectedly fell from 2.7% in March to just 1.8% in April. For the first time since June last year, Czech inflation was in within the CNB's 2 percent target.

In the Czech Republic between December 2023 and November 2024 the rate the central bank's interest rate was lowered from 7 percent to 4 percent, but in In December, the Czech National Bank has already postponed another rate cut , after eight in a row of reductions. Previously, for a year and a half the price money in CNB was kept unchanged at 7 percent.

The Czechs waited to start easing monetary policy until CPI inflation is close to the 2 percent target. But when they already started, they cut very dynamically.

When the CNB announced its decision, we in Poland were waiting for statement from the Monetary Policy Council. Economists expected a cut NBP interest rates by 50 basis points, to 5.25% in the case of the interest rate reference rate. For comparison, the main rate of the Hungarian central bank for several months is maintained at 6.50%. In Romania, it is 6.75%.

bankier.pl