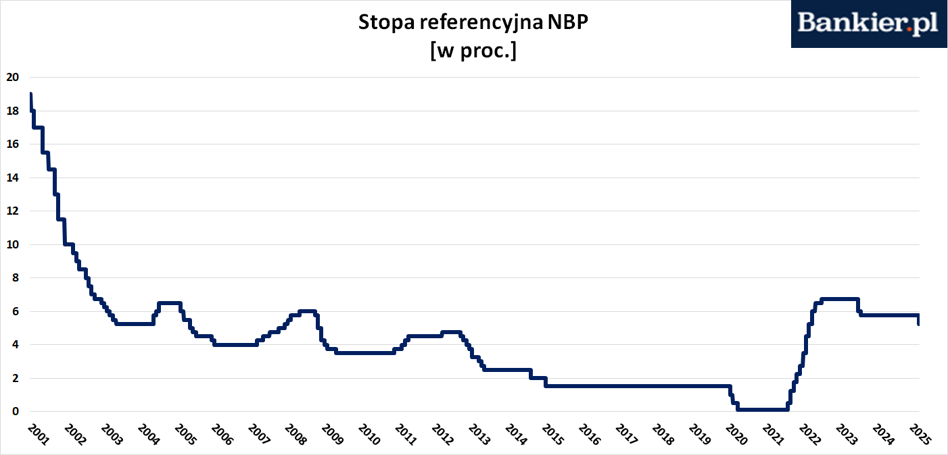

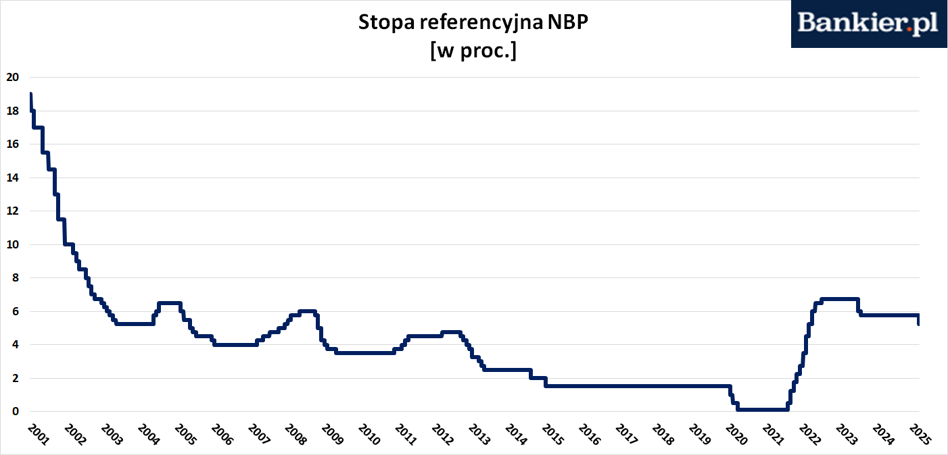

Sharp cut in NBP rates. The Council interrupted a long period of rate stabilization

The Monetary Policy Council decided at its May meeting cut the interest rates of the National Bank of Poland by 50 basis points. Such the easing of monetary policy was in line with the expectations of most analysts.

By decision of the Monetary Policy Council published on May 7, 2025, the interest rates The interest rates of the National Bank of Poland will be as follows:

- Reference rate: 5.25 percent per annum (previously 5.75 percent),

- Lombard rate: 5.75 percent per annum (previously 6.25 percent),

- deposit rate: 4.75 percent per annum (previously 5.25 percent),

- bill rediscount rate: 5.55 percent per annum (previously 5.80 percent),

- Bill discount rate: 5.60 percent per annum (previously: 5.85 percent)

This is the first decision to change NBP rates since October 2023 year. Earlier by the previous 17 meetings The Council voted to keep interest rates unchanged level . Such decisions were justified by the fact that CPI inflation is maintained above the 2.5 percent target with elevated core inflation.

Economists were not surprised by today's decision of the Monetary Policy Council . 20 of 21 economists surveyed by PAP expected cost reductions credit. The market consensus assumed a cut of 50 basis points at once. Now speculations regarding the course of the path of expected further rate cuts interest rates in the National Bank of Poland. Some economists expect that The Council will make a second 50-basis-point cut in June or July (when it becomes available) a new inflation projection) and then it will refrain from further cuts.

However, it cannot be ruled out that the Monetary Policy Council has just started a longer cycle of monetary policy easing. For the "target" level of interest rates both on the market and among economists the range of 3.5-4.0% is considered to be achieved but only in 2026. In this situation, in a dozen or so months the rate The NBP reference rate would be only slightly above the currently expected level CPI inflation.

The latter decreased from 4.9% to 4.3% in April, mainly as a result of falling fuel prices and the end of the low base effect in the case of prices food. Both effects should lead to a decrease in the annual CPI dynamics also in the next few years months. And in July, the effect of last year will expire a sharp increase in energy and gas tariffs.

The newest (i.e. March) inflation projection of the National Bank of Poland does not assume , for CPI inflation to reach the 2.5 percent target by 2027. with the central projection path, inflation in 2025 is expected to reach 4.9 percent, in 2026 this year – 3.4 percent, and in 2027 – 2.5 percent.

- Interest rates lower by about 1 percentage point in the horizon two years translate into inflation higher by about 0.7 percentage points two years later . This simple relationship does not depend on a specific rate level The additional 0.7 percentage points means that in 2027 we are outside the upper a series of deviations from the target. (...) In the light of the March and numerous previous projection any reduction today is a departure from the mandate and harm Polish economy - Joanna Tyrowicz said in April, quoted by DGP .

An official announcement is scheduled for 16:00 Monetary Policy Council containing the justification for today's decision. On Thursday at 3:00 p.m., the Chairman of the Council, Adam Glapiński. The tone of his statement may shed more light on the upcoming decisions MPC. The next meeting of the Council is to be held on 3-4 June.

bankier.pl