India on firm footing but it’s shaky ground globally, says FinMin review

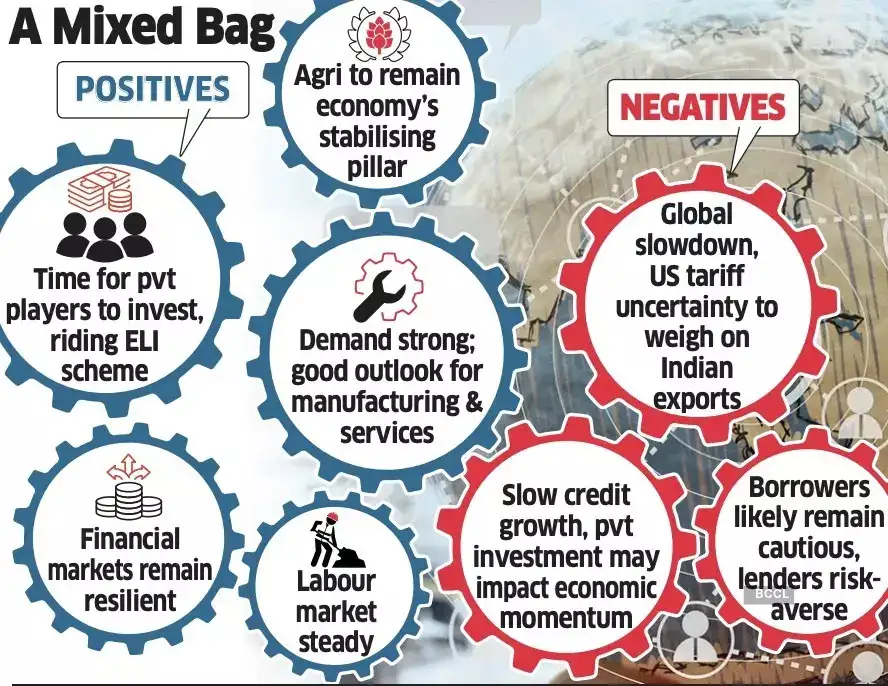

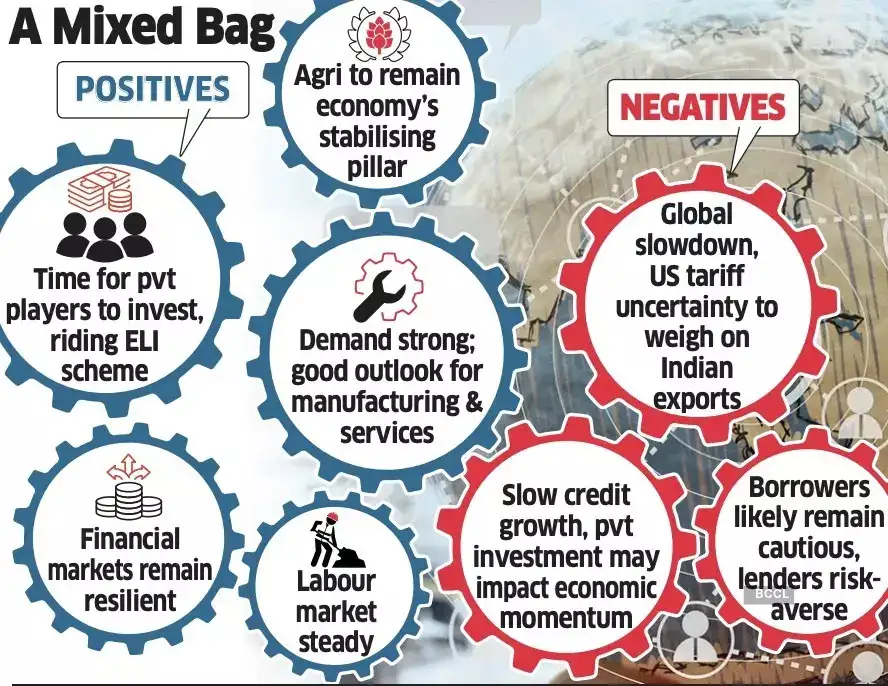

India has its economic task cut out over the medium term due to the ongoing “momentous shifts” in global supply chains amid the squeeze on semiconductors, rare earth magnets and other critical components, the finance ministry said on Monday. The finance ministry’s monthly economic review in June brought into focus China’s curbs on rare earth magnets — that have emerged as a key challenge for Indian manufacturers. It warned that a worldwide slowdown, especially in the US, could dampen demand for exports from India. The economy has the “look and feel of ‘steady as she goes’ as far as FY26 is concerned,” but continued uncertainty over US tariffs may be a drag, it said. The ministry also cautioned that slow credit growth and dull private investment appetite could hamper India's growth momentum. Nevertheless, it underscored the economy’s resilience and said it had entered the second quarter of FY26 on a relatively firm footing. Rate Cycle The ministry said core retail inflation remains subdued and headline inflation is comfortably below the central bank’s 4% target, “affording room for the easing cycle to be sustained.” FY26 inflation could come in below the Reserve Bank of India (RBI) expectation of 3.7%, it said. Global crude oil prices are expected to remain subdued, following a larger-than-anticipated production hike by Opec and allies, it added. The central bank started the latest rate-easing cycle in February and has cut the key repo rate by 100 basis points so far this year, to 5.5%. The ministry called on private sector companies to piggyback on government initiatives, such as the Employment Linked Incentive scheme, to bolster investment. It acknowledged that credit growth has slowed despite monetary easing and a strong bank balance sheet, reflecting cautious borrower sentiment and possibly risk-averse lender behaviour. A growing preference for the debt market by companies, particularly commercial paper, due to lower borrowing costs, may also partly explain the shift. The economy at this point presents a picture of “cautious optimism,” the report said. “Despite global headwinds marked by trade tensions, geopolitical volatility and external uncertainties, India’s macroeconomic fundamentals have remained resilient,” it said. Thanks to robust domestic demand, fiscal prudence and monetary support, India appears poised to continue as one of the fastest-growing major economies, with various forecasters projecting FY26 growth rate of 6.2–6.5%, it said. The farm sector’s performance, backed by adequate rainfall and water reserves, continues to serve as a stabilising pillar for the broader economy and will bolster rural demand outlook, said the report. It cited the rural sentiment survey by the National Bank for Agriculture and Rural Development (Nabard). This said 74.7% of rural households expected income growth in the coming year, the most since the survey’s inception. The finmin report called for analysing economic momentum in nominal quantities as well, given the deflationary trend in the wholesale price index.

Rate Cycle The ministry said core retail inflation remains subdued and headline inflation is comfortably below the central bank’s 4% target, “affording room for the easing cycle to be sustained.” FY26 inflation could come in below the Reserve Bank of India (RBI) expectation of 3.7%, it said. Global crude oil prices are expected to remain subdued, following a larger-than-anticipated production hike by Opec and allies, it added. The central bank started the latest rate-easing cycle in February and has cut the key repo rate by 100 basis points so far this year, to 5.5%. The ministry called on private sector companies to piggyback on government initiatives, such as the Employment Linked Incentive scheme, to bolster investment. It acknowledged that credit growth has slowed despite monetary easing and a strong bank balance sheet, reflecting cautious borrower sentiment and possibly risk-averse lender behaviour. A growing preference for the debt market by companies, particularly commercial paper, due to lower borrowing costs, may also partly explain the shift. The economy at this point presents a picture of “cautious optimism,” the report said. “Despite global headwinds marked by trade tensions, geopolitical volatility and external uncertainties, India’s macroeconomic fundamentals have remained resilient,” it said. Thanks to robust domestic demand, fiscal prudence and monetary support, India appears poised to continue as one of the fastest-growing major economies, with various forecasters projecting FY26 growth rate of 6.2–6.5%, it said. The farm sector’s performance, backed by adequate rainfall and water reserves, continues to serve as a stabilising pillar for the broader economy and will bolster rural demand outlook, said the report. It cited the rural sentiment survey by the National Bank for Agriculture and Rural Development (Nabard). This said 74.7% of rural households expected income growth in the coming year, the most since the survey’s inception. The finmin report called for analysing economic momentum in nominal quantities as well, given the deflationary trend in the wholesale price index.

Rate Cycle The ministry said core retail inflation remains subdued and headline inflation is comfortably below the central bank’s 4% target, “affording room for the easing cycle to be sustained.” FY26 inflation could come in below the Reserve Bank of India (RBI) expectation of 3.7%, it said. Global crude oil prices are expected to remain subdued, following a larger-than-anticipated production hike by Opec and allies, it added. The central bank started the latest rate-easing cycle in February and has cut the key repo rate by 100 basis points so far this year, to 5.5%. The ministry called on private sector companies to piggyback on government initiatives, such as the Employment Linked Incentive scheme, to bolster investment. It acknowledged that credit growth has slowed despite monetary easing and a strong bank balance sheet, reflecting cautious borrower sentiment and possibly risk-averse lender behaviour. A growing preference for the debt market by companies, particularly commercial paper, due to lower borrowing costs, may also partly explain the shift. The economy at this point presents a picture of “cautious optimism,” the report said. “Despite global headwinds marked by trade tensions, geopolitical volatility and external uncertainties, India’s macroeconomic fundamentals have remained resilient,” it said. Thanks to robust domestic demand, fiscal prudence and monetary support, India appears poised to continue as one of the fastest-growing major economies, with various forecasters projecting FY26 growth rate of 6.2–6.5%, it said. The farm sector’s performance, backed by adequate rainfall and water reserves, continues to serve as a stabilising pillar for the broader economy and will bolster rural demand outlook, said the report. It cited the rural sentiment survey by the National Bank for Agriculture and Rural Development (Nabard). This said 74.7% of rural households expected income growth in the coming year, the most since the survey’s inception. The finmin report called for analysing economic momentum in nominal quantities as well, given the deflationary trend in the wholesale price index.

Rate Cycle The ministry said core retail inflation remains subdued and headline inflation is comfortably below the central bank’s 4% target, “affording room for the easing cycle to be sustained.” FY26 inflation could come in below the Reserve Bank of India (RBI) expectation of 3.7%, it said. Global crude oil prices are expected to remain subdued, following a larger-than-anticipated production hike by Opec and allies, it added. The central bank started the latest rate-easing cycle in February and has cut the key repo rate by 100 basis points so far this year, to 5.5%. The ministry called on private sector companies to piggyback on government initiatives, such as the Employment Linked Incentive scheme, to bolster investment. It acknowledged that credit growth has slowed despite monetary easing and a strong bank balance sheet, reflecting cautious borrower sentiment and possibly risk-averse lender behaviour. A growing preference for the debt market by companies, particularly commercial paper, due to lower borrowing costs, may also partly explain the shift. The economy at this point presents a picture of “cautious optimism,” the report said. “Despite global headwinds marked by trade tensions, geopolitical volatility and external uncertainties, India’s macroeconomic fundamentals have remained resilient,” it said. Thanks to robust domestic demand, fiscal prudence and monetary support, India appears poised to continue as one of the fastest-growing major economies, with various forecasters projecting FY26 growth rate of 6.2–6.5%, it said. The farm sector’s performance, backed by adequate rainfall and water reserves, continues to serve as a stabilising pillar for the broader economy and will bolster rural demand outlook, said the report. It cited the rural sentiment survey by the National Bank for Agriculture and Rural Development (Nabard). This said 74.7% of rural households expected income growth in the coming year, the most since the survey’s inception. The finmin report called for analysing economic momentum in nominal quantities as well, given the deflationary trend in the wholesale price index.economictimes