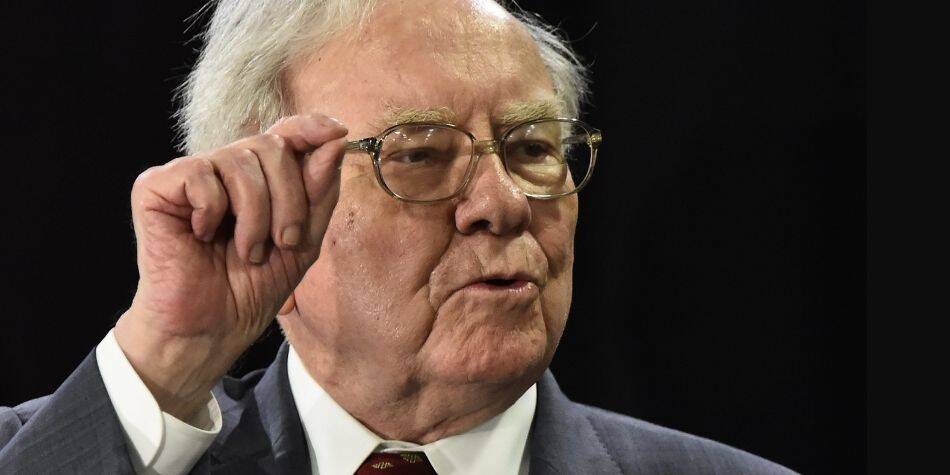

Billionaire Warren Buffett is stepping down as chairman of his Berkshire Hathaway empire. Who will replace him?

Warren Buffett, one of the richest men on the planet, has announced his retirement. At 94 years old—he was born in Omaha, Nebraska, USA, on August 30, 1930—and with an estimated fortune of around $168.2 billion, according to Forbes magazine's wealth list, he will step down as chairman of the business empire he built over decades, Berkshire Hathaway, with a formula that worked well for him: buy cheap, upgrade, and sell at a better price.

He announced his retirement this Saturday, at the same time as he announced his successor in the business empire, which encompasses both public and private companies. Some of his best-known investments include Apple, Coca-Cola, Bank of America, American Express, Chevron, T-Mobile, and Nu Holdings, the latter founded by Colombian David Vélez.

Buffett's business acumen, nicknamed "The Oracle of Omaha" in reference to his hometown in Nebraska, has made him a highly influential figure in the business and financial worlds, leading to stakes in private companies such as the insurance company Geico; the global battery manufacturer Duracell; the restaurant chain Dairy Queen; and the chemical manufacturer Lubrizol, among many others.

"The time has come for Greg Abel—62, currently vice chairman of Berkshire Hathaway—to become the company's chairman at the end of the year," the 94-year-old billionaire said during the conglomerate's annual shareholders meeting at its headquarters in Omaha.

Buffett added that he believed the board would unanimously support his recommendation. "I would remain active and could be helpful in some cases, but Greg would have the final say on operations, capital expenditures, or whatever," he emphasized.

Berkshire Hathaway was a mid-sized textile company when Buffett bought it in the 1960s. He grew it into a giant conglomerate, now valued at over $1 trillion and with liquid assets of $300 billion.

The successor Gregory Edward Abel is a Canadian businessman, Chairman and CEO of Berkshire Hathaway Energy and Vice Chairman of Berkshire Hathaway's Non-Insurance Operations since January 2018.

He began his career as a public accountant at PricewaterhouseCoopers. In 1992, he joined CalEnergy, a geothermal electricity producer, which acquired MidAmerican Energy in 1999. Berkshire Hathaway acquired a majority stake that same year. Abel became CEO of MidAmerican in 2008, and the company was spun off as Berkshire Hathaway Energy six years later.

Attendees at Berkshire Hathaway's annual shareholders' meeting in Omaha, Nebraska, USA. Photo: Bloomberg

Spartan Capital Securities analyst Peter Cardillo described Buffett as "the wizard of Wall Street" and said his announcement helps ease uncertainty about his succession. "This helps alleviate concerns about who will replace him and could be very well received by his supporters," Cardillo told AFP.

Berkshire Hathaway reported first-quarter earnings of $9.6 billion, down 14 percent from the same period last year. This equates to $4.47 per share, also a sharp decline.

"I have no intention of selling a single share of Berkshire Hathaway," Buffett told shareholders , who responded with a standing ovation. "The decision to hold each share is an economic decision because I believe Berkshire's prospects will be better under Greg's management than under mine," he added.

"So that's the news of the day," he joked. "Greg Abel and the rest of the team have a big challenge ahead of them, and they have huge amounts of cash to put to work if they so choose," opined Steve Sosnick of Interactive Brokers. "This is truly the end of an era," he noted.

'Act of war' During Berkshire's annual shareholders' meeting, Buffett also opined that "trade should not be a weapon," a clear reference to U.S. President Donald Trump's aggressive use of tariffs against countries around the world. "There is no doubt that trade can be an act of war," he said.

Warren Buffett is the eighth richest man in the world, according to Forbes. Photo: Larry W. Smith. EFE Archive

Buffett's comments came as analysts in the United States and elsewhere have expressed growing concern that tariffs could seriously slow global growth. The billionaire had said two months ago in an interview with CBS that tariffs "are a tax on goods," not a relatively painless revenue generator, as Trump has suggested.

On Saturday, Buffett urged Washington to continue trading with the rest of the world. "We should do what we do best, and they should do what they do best. That's what we originally did," he said. He added that it can be dangerous for a country to offend the rest of the world by proclaiming superiority.

"It's a big mistake, in my opinion, to have 7.5 billion people who don't like you very much, and 300 million who are somehow bragging about how well they've done," Buffett told shareholders.

Buffet's investments Through his Warren Buffett Group, he holds stakes in more than 70 companies across a variety of sectors, including finance, insurance, aviation, mining, food, furniture, and business services, among many others. Here's a summary of the most significant ones:

Public companies (shares of listed companies):

- Apple (AAPL): One of the largest holdings in the portfolio.

- Coca-Cola (KO): Buffett has held this investment for decades.

- Bank of America (BAC): One of its main financial investments.

- American Express (AXP): Buffett holds it for its strong brand and presence.

- Chevron (CVX): Another of the large holdings in the portfolio.

- Others: Also includes investments in companies such as T-Mobile and Nu Holdings.

Private companies (wholly owned operations):

- GEICO: Insurance company.

- Duracell: Battery manufacturer.

- Dairy Queen: Restaurant chain.

- BNSF: Railroad.

- Lubrizol: Chemical manufacturer.

- Fruit of the Loom: Underwear brand.

- Helzberg Diamonds: Jewelry.

- Long & Foster: Real Estate.

- FlightSafety International: Aviation training service provider.

- Pampered Chef: Kitchenware Company.

- Forest River: Recreational Vehicle Manufacturer.

- NetJets: Private aviation company.

* Note prepared with support from agencies.

eltiempo