Fixed-term deposits in dollars: how much does it yield today and which bank pays the most?

Fixed-term deposits in dollars are once again an option. See how much $2,000 for 30 days will yield today and which bank offers the best rate.

The liberalization of the foreign exchange market ordered by Luis Caputo revived interest in dollar deposits. Without restrictions on access to the currency, major banks began adjusting their interest rates to attract savings in foreign currency.

Banco Nación leads the way with a 2.50% Annual Nominal Rate (ANR) for 30-day fixed-term deposits, significantly surpassing other institutions. Although rates remain lower than those for peso-denominated fixed-term deposits, savers are once again considering the dollar as a safe haven.

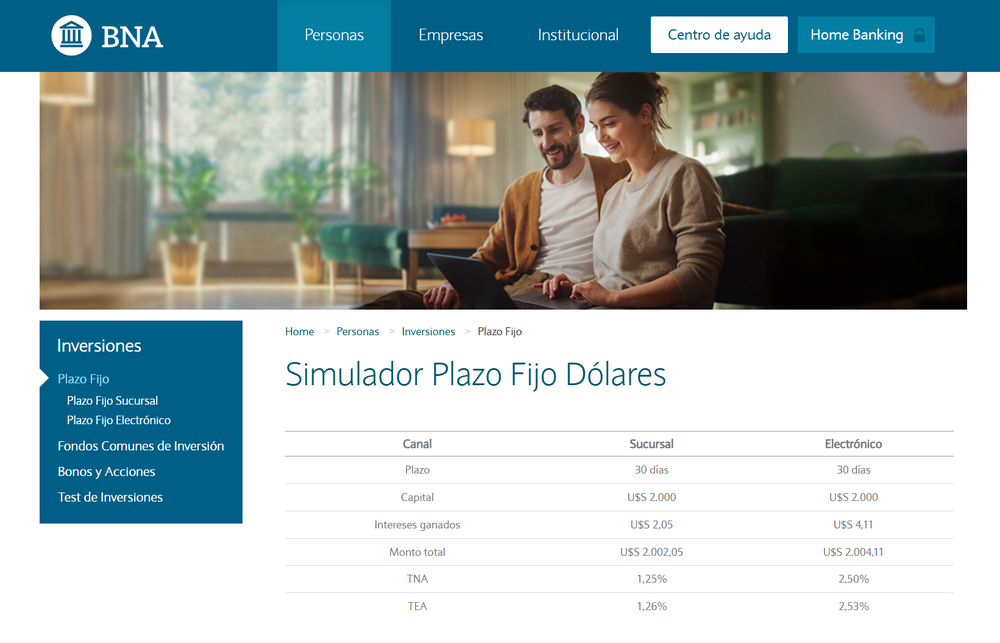

With a 30-day deposit of US$2,000 , Banco Nación offers the highest yield on the market. According to the simulator, by making the deposit electronically, the customer earns US$4.11 in interest, with an APR of 2.50% and an Annual Effective Rate (AER) of 2.53%. However, if deposited in a branch, the interest earned is US$2.05, with an APR of 1.25%.

image

According to the various percentages, Banco Nación is the institution that offers the highest interest rate for 30-day dollar deposits. Online, a US$2,000 fixed-term deposit earns US$4.11, while in a branch, the interest rate drops to US$2.05.

Rates vary between banks, and consequently, so do the yields. Below is the estimated yield in dollars for a 30-day placement of $2,000 with each bank:

- Banco Nación : 2.50% APR → US$4.11

- Banco Galicia : 2.40% APR → US$3.95

- Banco Macro : 1.75% TNA → U$S 2.88

- BBVA Bank : 1.25% APR → US$2.05

- Banco Patagonia : 1.25% TNA → U$S 2.05

- Mortgage Bank : 0.25% APR → US$ 0.41

- Banco Ciudad : 0.10% APR → US$ 0.16

- Banco Santander : 0.05% TNA → U$S 0.08

- Topics

- Fixed term

- Dollars

- Bank

- Luis Caputo

losandes