The tax burden accounts for up to 62% of wine sales and is almost double what is paid in Chile.

With data updated to 2025, the current tax burden in Argentina represents 57.1% of a farm's pure production surplus and 62.4% of a winery's pure production surplus.

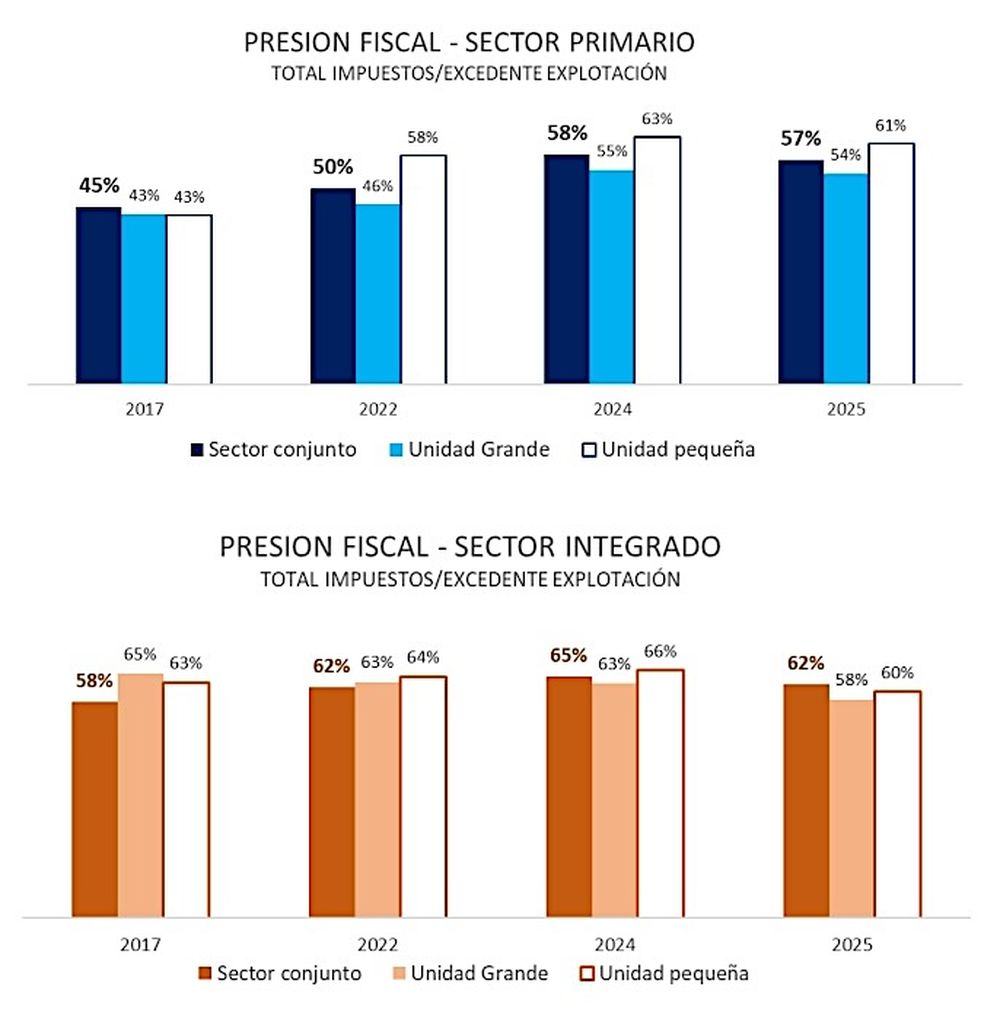

This pressure rises to 61.2% for small farms and drops to 53.6% for large farms ; while for small wineries, it stands at 63.4%, and for large wineries, it stands at 58.4%, the report highlights.

Pure production surplus is understood as the difference between total revenue less costs , minus taxes . Of this difference, taxes account for 57.1% on a farm and 62.4% on a winery.

Report on the tax burden on wine production in Argentina prepared by the Faculty of Economics of the National University of Cuyo for Coviar

Gentleness

Another way to understand the impact of taxes is to consider the example of a winery in Mendoza that produces its own wine grapes.

In this case, production, sales, and administrative costs account for 81% of total revenue (100%) , leaving an initial profit of 19%. Of this production surplus (19%), taxes account for 62.4%.

Three key conclusions emerge from these figures: the tax burden on winemaking in Argentina is higher than the national average and almost doubles what a farm or winery pays in Chile . And in the historical analysis, since it began to be measured in 2017, it has been increasing.

The fact that taxes paid in the wine industry in Argentina account for 57.1% of a farm's operating surplus or 62.4% of the same surplus for a winery are high figures, even for the national economy and higher than the average for countries in the region.

According to the report by the Faculty of Economic Sciences of UNCuyo, it exceeds the average tax pressure for economic activities in Mendoza (39%) , the national average pressure in Argentina, which is 37.7% on the operating surplus, and even that of Brazil (40.4%) and Chile (20.8%).

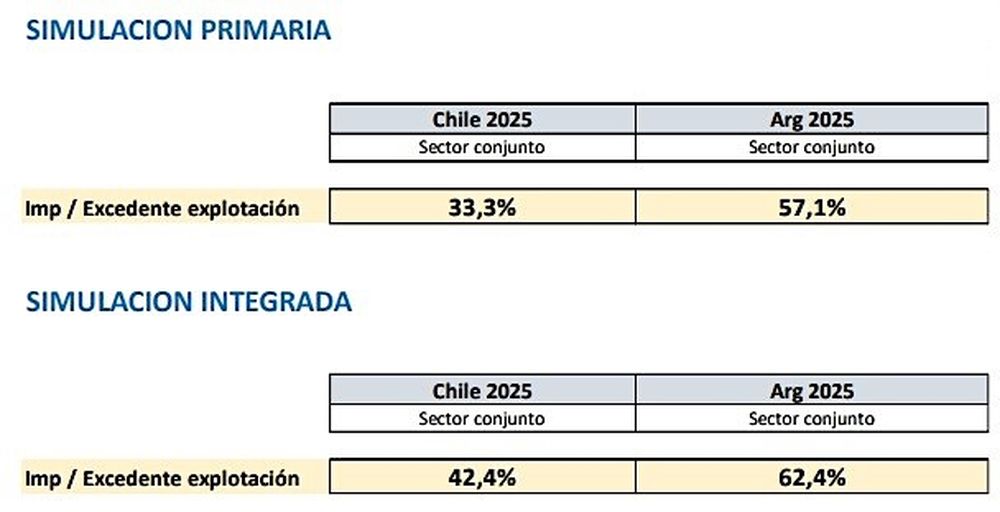

Specifically in Chile, while the average farm's taxes account for 33.3% of its net operating surplus, in Argentina they represent 57.1%. For a winery, taxes in Chile account for 42.4% of its net operating surplus, while in Argentina they represent 62.4%.

Report on the tax burden on wine production in Argentina prepared by the Faculty of Economics of the National University of Cuyo for Coviar

Gentleness

As can be seen in this graph, from 2017 when the first report was made, until now, the tax burden for a farm rose from 45% to 57.1% , while for a winery it went from 58% to 62%.

Report on the tax burden on wine production in Argentina prepared by the Faculty of Economics of the National University of Cuyo for Coviar

Gentleness

Regarding methodological aspects, "tax burden" is defined as the relationship between: the total taxes paid by the company (winery or farm) and the pure business operating surplus , which is the result (difference between total income less production costs, excluding taxes).

The estimate was made for two types of scenarios, each corresponding to a type of wine-growing operation: a "primary" operation, which only includes the agricultural stage up to the sale of the grapes to a winery, and an "integrated" operation, that is, one that includes the agricultural stage, the transition to wine production and its fractionation , up to its sale in the cellar (the wine that goes to the commercial channel).

A distinction is made between small and large farms and wineries based on total grape production estimated in quintals and total production in units of wine bottles, demijohns, tetras, and bag-in-box.

The following taxes are taken into account in the calculation: Income, VAT, Gross Income, Property taxes, Tax on bank debits and credits, Taxes included in the purchase of energy , Taxes included in the purchase of fuel, Taxes included in the hiring of labor and Taxes included in the purchase of other inputs.

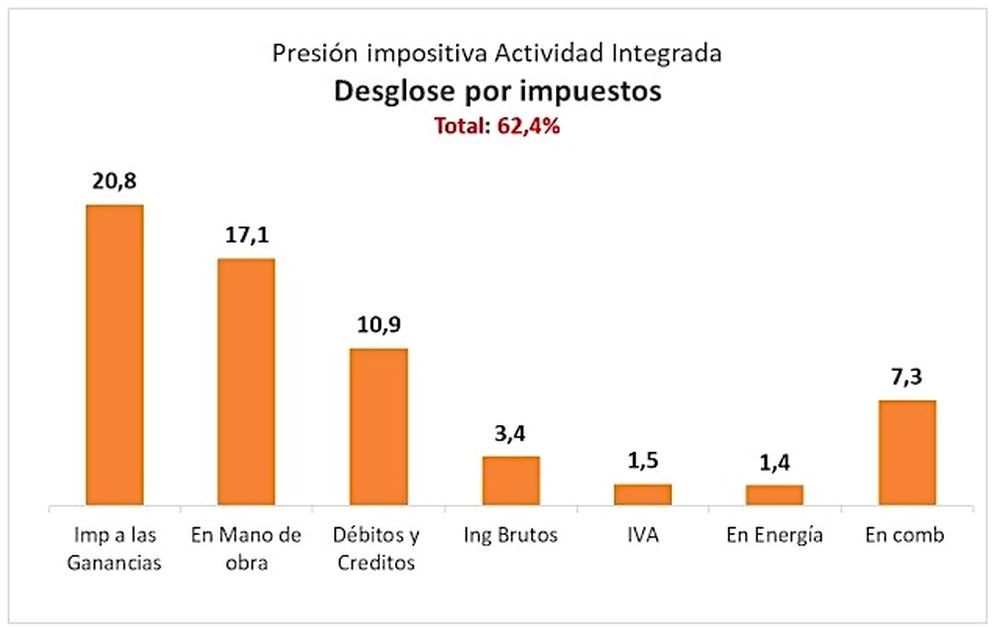

Which taxes have the greatest weight?The report by economists from the Faculty of Economic Sciences at UNCuyo , updated at the request of COVIAR , identified which taxes are the "main culprits" by having a greater relative weight on the tax burden of 62.4% that weighs, for example, on a winery with a farm (integrated) in Mendoza.

Tax Breakdown of Integrated Winery Activity.jpg

Gentleness

For a winery that has a farm and produces its own grapes for winemaking, the three main taxes it must pay are Income Tax, which represents 20.8 points of the 62.4% of total tax pressure, taxes on work or labor (17.1%) and Debits and Credits , better known as Check Tax, which represents 10.9 percentage points.

In fourth place, with a share of 3.4 points, is Gross Income , a provincial tax. The entire bulk of the tax is under national jurisdiction.

losandes