Dividend harvest, Orlen rally and core inflation at 5-year low. Week on charts

Although the past week is a week with a "long weekend", we have plenty of weekly charts. We learned the latest data on core inflation, the Fed's decision on interest rates in the US and watched the rally of Orlen, whose shares are the most expensive in 3 years. We invite you to a summary on charts of the penultimate week before the holidays.

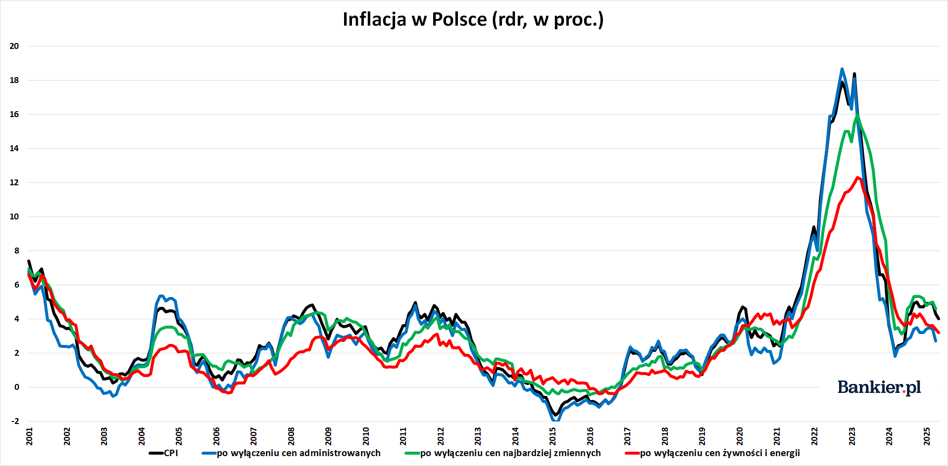

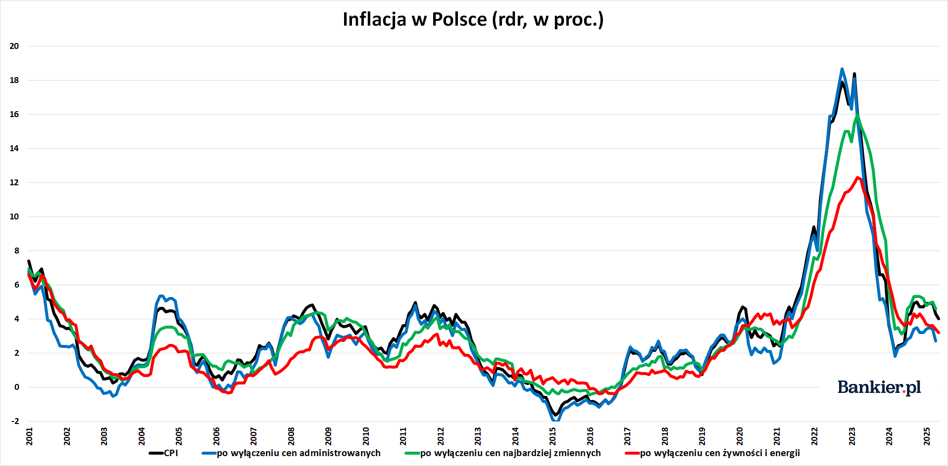

Core inflation in May 2025 reached its lowest level level since January 2020 – according to data from the National Bank of Poland. It was also the second month in a row when this measure of price growth was within permissible range of fluctuations from the inflation target.

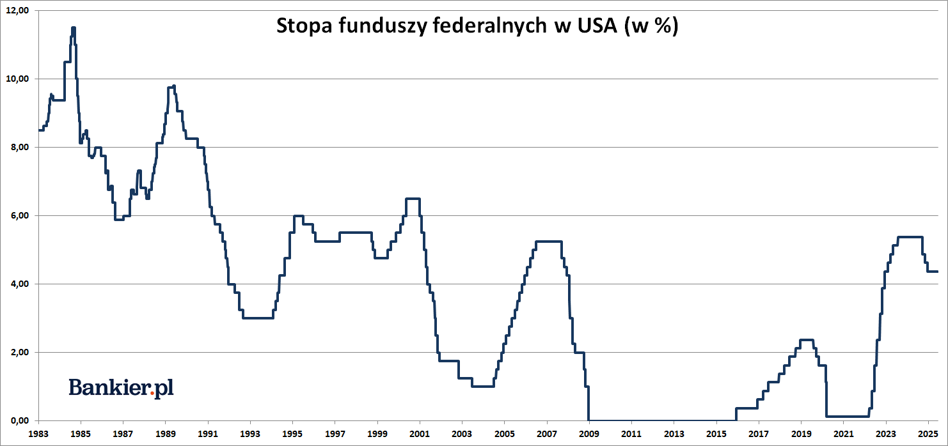

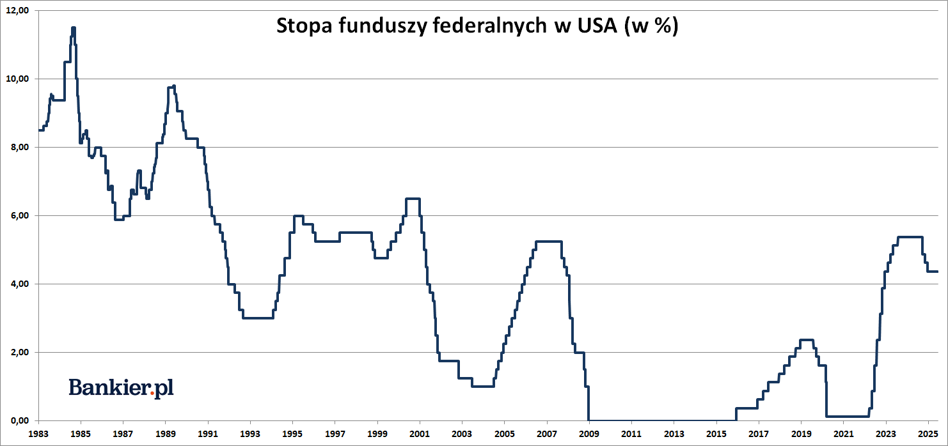

Federal Reserve management did not bow to pressure President Donald Trump and again did not lower interest rates despite insistence of the head of state. The "pause" in the interest rate cuts cycle has lasted for half year.

Since Donald Trump was elected US President, the People's Bank of China continues to increase its gold reserves. Data for May showed that the smallest purchase volume at that time, but confirmed the determination buying metal, even at record prices.

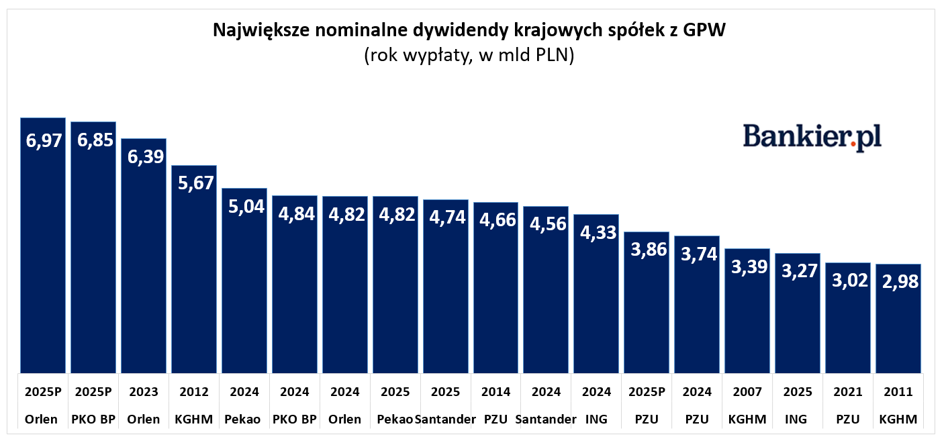

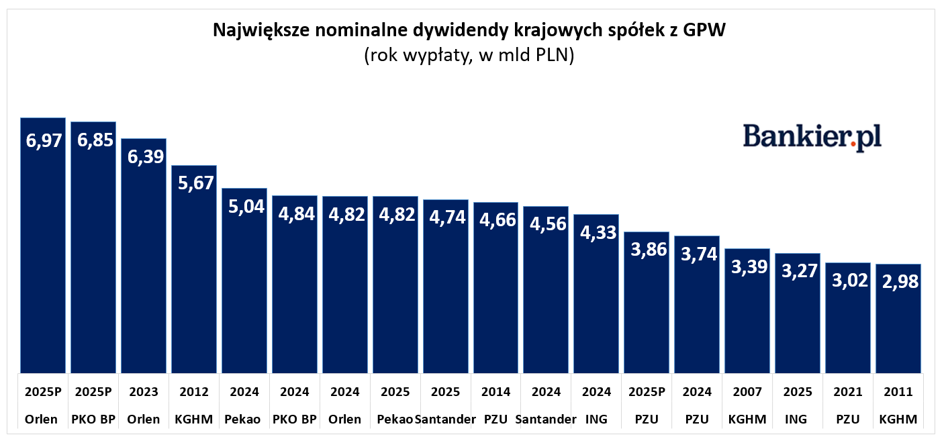

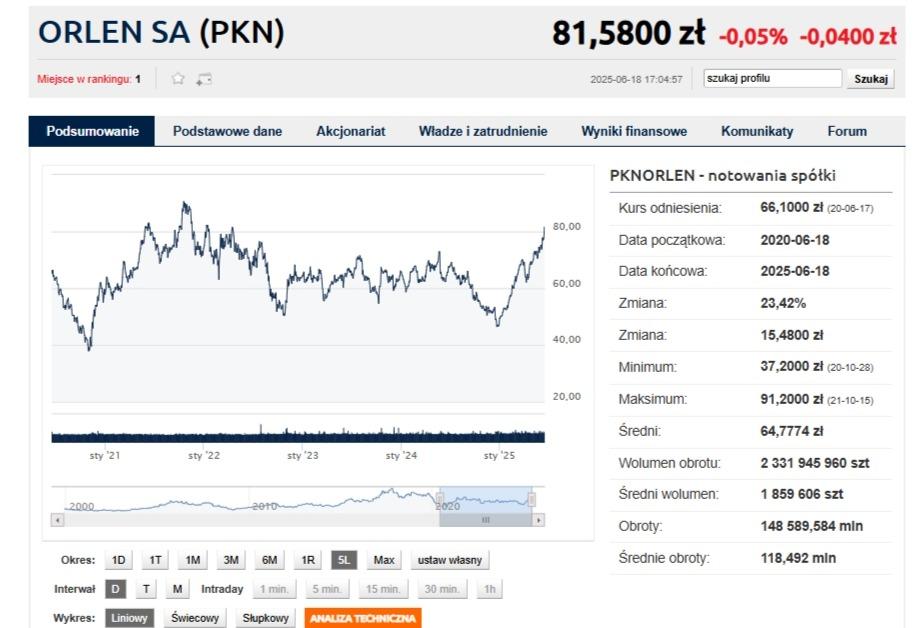

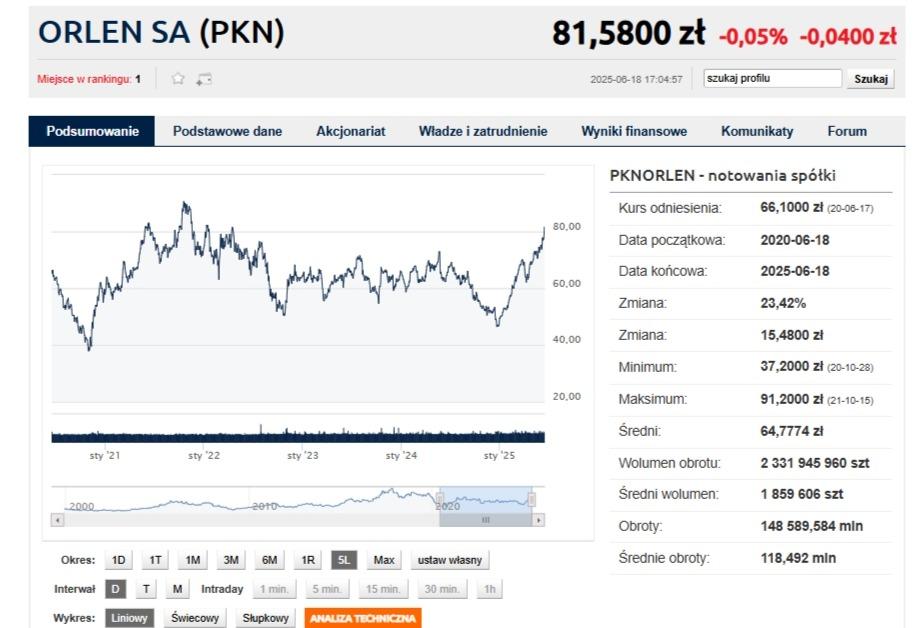

The largest state-owned companies generously share their profits in the form of dividends, which benefits the state and its budget. PZU, PKO and Orlen will pay the State Treasury almost PLN 7 billion. Such money from the profits of national champions has not flowed for long time.

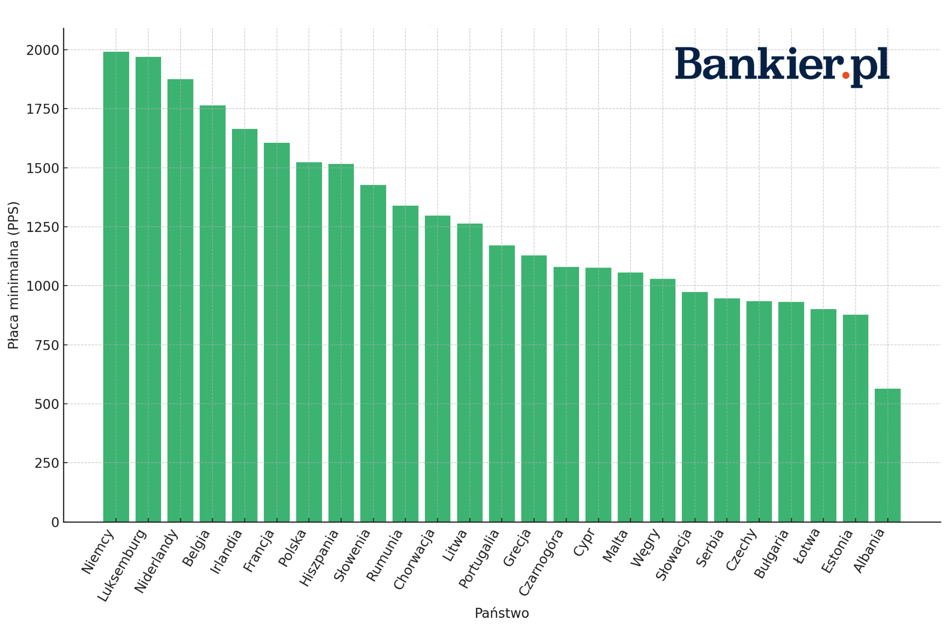

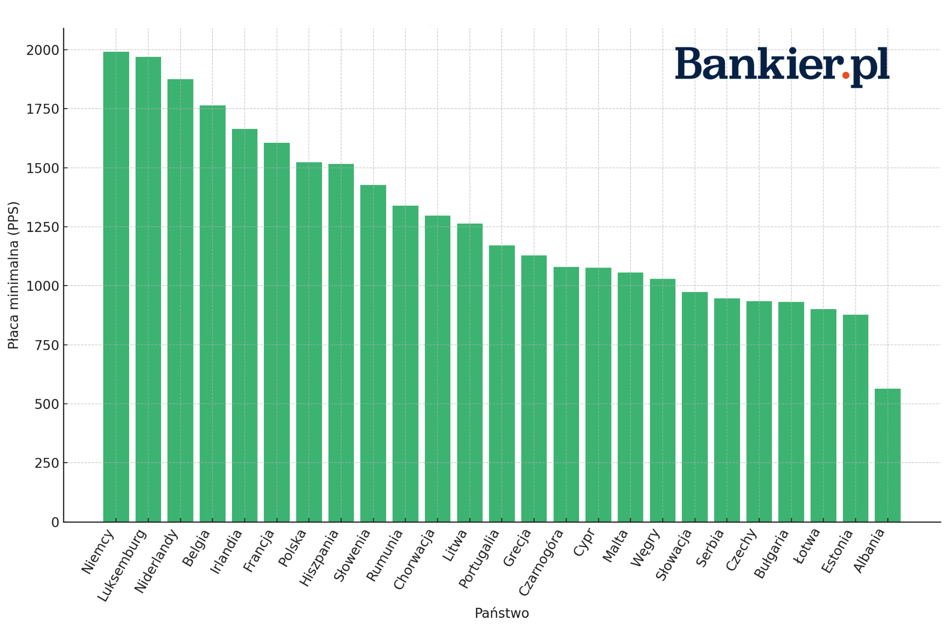

Although all signs in the sky and on earth indicate that in the coming year the minimum wage, mainly due to resistance from the Ministry of Finance, will not yet break the magic barrier of 5,000 zlotys, the salaries of Poles are nevertheless already at a level closer to Western than Eastern or Southern Europe. All because of their purchasing power.

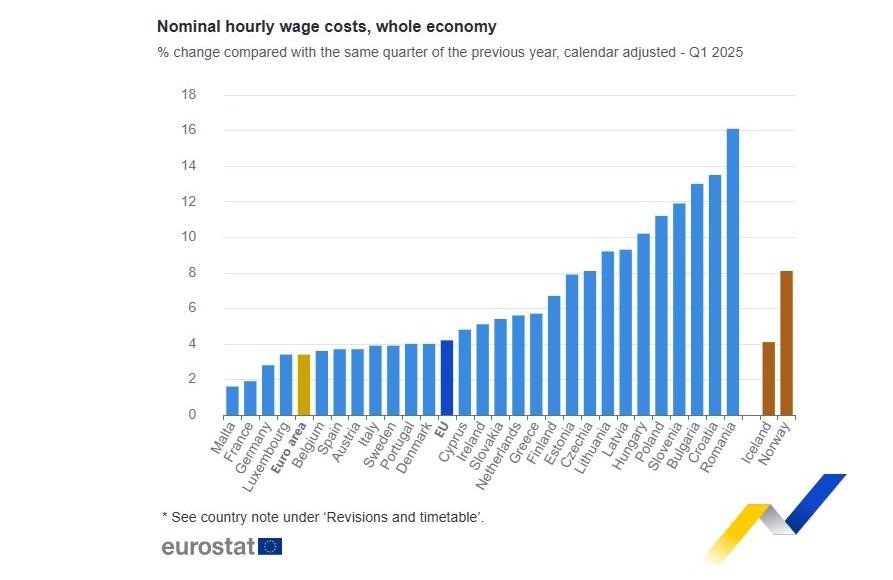

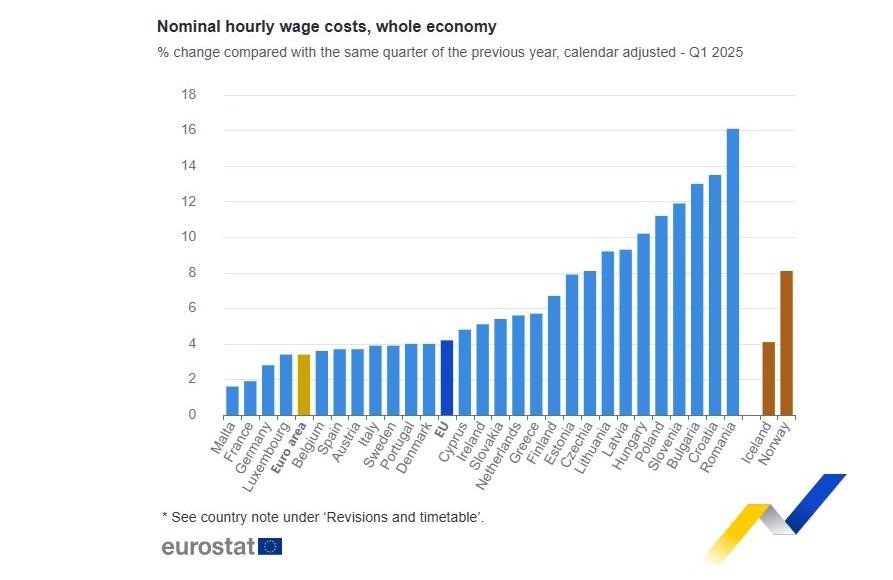

Across the European Union, nominal hourly labor costs rose by 4.1% in the first quarter of this year compared to the same quarter a year ago, after a 4.3% year-on-year increase in the fourth quarter of 2024, Eurostat reported. The highest increases were recorded in Romania, Croatia, Bulgaria, Slovenia and Poland.

Orlen has recently attracted attention, with its share price at the highest level in over three years and capitalization of nearly PLN 95 billion, making it currently the largest of all WIG20 companies.

Investing on the alternative market NewConnect is full of dangers. Issuers listed there have often been able to surprise negatively its shareholders. That this is a rather "exotic" market in terms of content published stock exchange announcements, are evidenced by examples that only Over the past few months, market observers have been able to become acquainted with

prepared by KWS

bankier.pl