ECB has no mercy on interest rates. We are realistically at zero

The European Central Bank has decided to the eighth consecutive interest rate cut, bringing the deposit rate down to near current HICP inflation. In this case, the real interest rate in the euro area was close to zero.

- The Governing Council decided today to lower three key ECB interest rates by 25 basis points. In particular, the decision to lowering the deposit rate – through which the Governing Council controls the attitude monetary policy – is based on an updated forecast of inflation, dynamics inflation processes and the monetary transmission force – we read in the June issue statement by the European Central Bank.

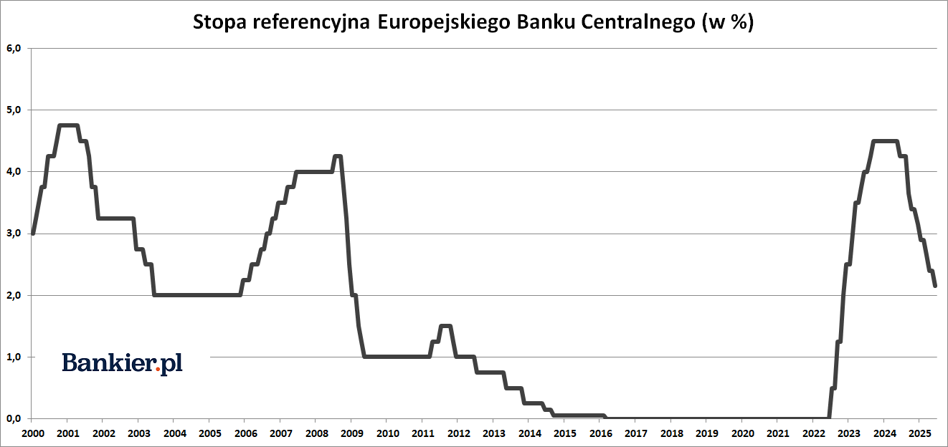

The interest rate on the main refinancing operations will be reduced from 2.40% to 2.15 %. The deposit rate will go down from 2.25% to 2.00 % and the credit rate from 2.65 % to 2.40%. In this way, the basic interest rate at the ECB (which has been year is the deposit interest rate) almost equaled inflation HCIP for the last 12 months, which was 1.9% in May. This means that the real the ex post interest rate in the euro area is currently close to zero .

So this is the final one the end of the episode of slightly restrictive monetary policy in the euro zone . Earlier, in the years 2010-23, the European Central Bank almost continuously kept interest rates below the HICP inflation in the eurozone. The real rate The interest rate in the euro zone was therefore negative for almost the entire period. It looks that after less than two years of real positive rates we are returning to the zone real negative values.

- Inflation is currently at a level similar to to the Governing Council's medium-term objective of 2% . In the baseline scenario of the new Eurosystem staff projections, inflation overall, it will average 2.0% in 2025, 1.6% in 2026 and 2.0% in 2027. Downward revisions – by 0.3 percentage points for 2025 and 2026 – compared to the March projections, they are mainly reflecting the strengthening of the euro and the adoption in the assumption of lower energy prices. Inflation excluding prices energy and food according to expert predictions, which from March onwards remained unchanged, will average 2.4% in 2025 and 1.9% in 2026 and 2027. - yes, June decision the Governing Council explained.

The June decision of the Governing Council could not be helpful to anyone. surprise. The market widely expected interest rate cuts in 25 basis points. In April, Goldman Sachs analysts predicted a cut in June and another one in July (also by 25 bps). In their opinion, "the level target” will be 1.50%. So most likely below the rate HICP inflation.

- Most core inflation indicators show that inflation will permanently stabilize at a level close to the medium term The Governing Council's target of 2%. Wage growth remains elevated, but it is still clearly weakening and its inflationary impact is partially amortized by profits. Fears have diminished that increased uncertainty and volatile market response to April trade tensions will lead to tightening of financing conditions – it was written in June announcement ECB.

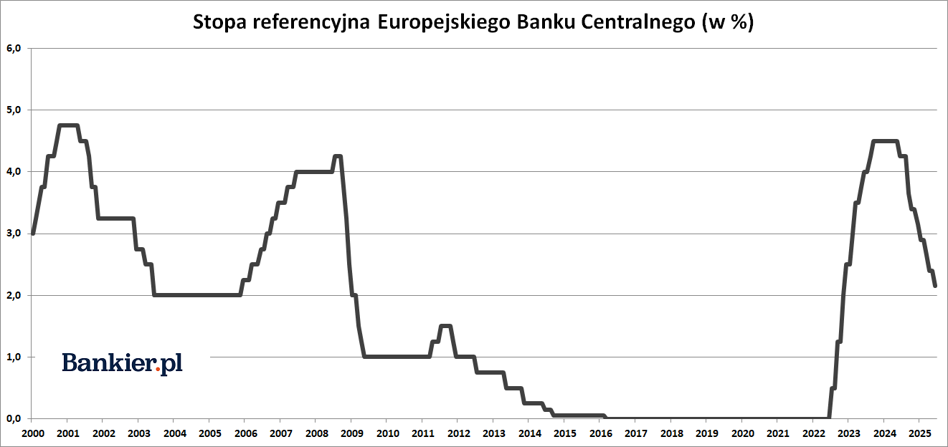

ECB cuts and doesn't look backIt was the eighth cut in interest rates by the European Central Bank. Central as part of the policy easing cycle that began in 2024 money. In In June last year, a decision was made to cut interest rates for the first time since 2019. interest rates in the euro zone. Previously, for nine months, interest rates at the ECB were maintained at their highest levels since 2001. The total scale of these reductions amount to 200 basis points in the case of the deposit rate and 235 basis points in the case of refinancing operation rates.

Previous the reduction in the cost of credit at the ECB took place in April . Earlier the Frankfurt institution cut rates at the beginning March and under end of January . In mid- December The Governing Council also lowered borrowing costs by 25 basis points . In October, the ECB decided to cut rates by 25 basis points , and in In September, it also lowered the deposit rate by 25 basis points , while reducing the reference rate by as much as 60 basis points as part of the plan announced in March "narrowing" the interest rate corridor.

The easing of monetary policy at the ECB has started for several months before the HICP inflation in the eurozone fell to the level desired by the bank central level. Only last month euroinflation was below the allowable 2% . It was only the second reading below 2% over the last four years.

- The Governing Council is determined to achieve this, for inflation to stabilise permanently at the target level of 2% in the medium term. Considering in particular the current extraordinary conditions uncertainty, the Governing Council will determine the appropriate policy stance monetary data and on an ongoing basis, from the meeting on meeting – the eurozone monetary authorities assured once again, dispelling any doubts of the skeptics.

But quantitatively it continues to tighten policyIn parallel to the interest rate cuts, the ECB is conducting policy of "quantitative tightening" (QT) of monetary conditions. Within the QT The APP portfolio is reduced at a specific and predictable rate pace because the Eurosystem no longer reinvests the principal payments from maturing securities. As of July 2023, the Governing Council has ceased reinvestment under the APP programme.

APP and PEPP portfolios are being reduced at a specific and predictable pace, as the Eurosystem does not is already reinvesting the capital repayments from maturing securities securities – it was written. The ECB has stopped reinvesting under the programme PEPP at the end of 2024.

The next meeting of the Governing Council is scheduled for 23-24 July.

bankier.pl