Gold Correction: Is This the End or Just the Beginning?

Since April, gold prices have not been setting new highs peaks. The market is in a correction. For now, it is quite "flat", but it has a chance deepen even more. However, this does not change my belief that the market gold is in a secular uptrend.

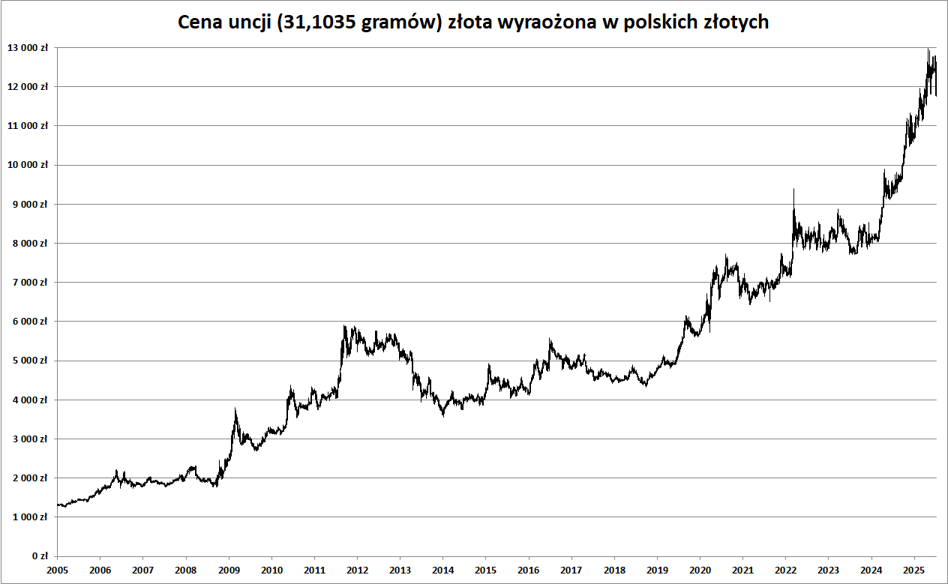

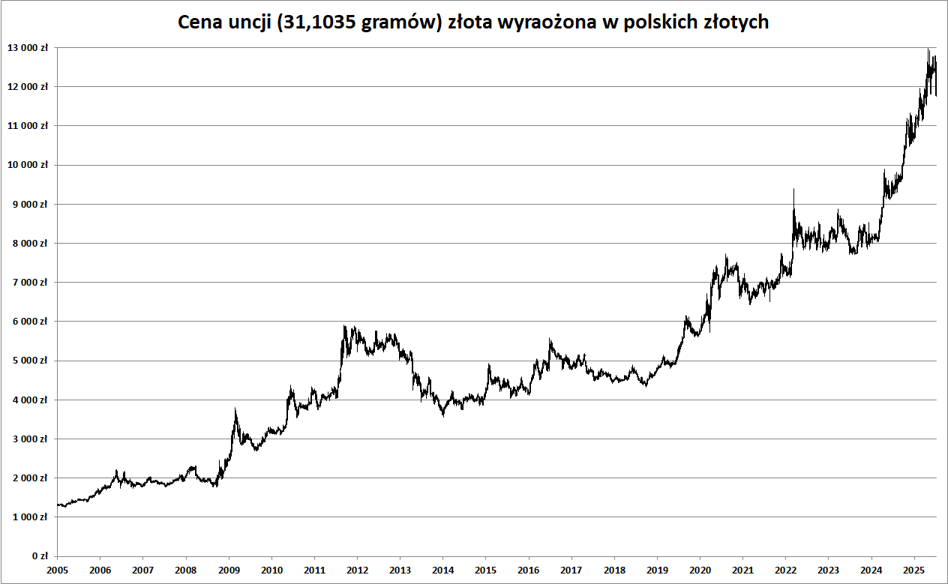

In the spring of AD 2025, gold became the media's favorite asset financial. The royal metal was proverbially "crawling out of the fridge" - where you didn't look, they were talking about gold . And it's hard not to notice no wonder. On April 22, the most liquid futures series priced an ounce Trojan yellow metal even at USD 3,509. It was a historic event, as real (i.e. after taking into account the official CPI inflation for the USA) rates gold prices after 45 years exceeded the record from January 1980. It takes a long time was to wait for it.

From today's point of view one could say: and that would be was that much. Because for the next few weeks the gold market was in correction, which has turned into a boring sideways trend since mid-May. So far, the biggest the range of this correction is less than 11%. This is very little considering the scale even an upward wave from only the first four months of 2024.

Something else catches my attention. The gold rate has not set new records, despite very favorable circumstances. That is, a very clear depreciation of the dollar and a sudden escalation of tensions in the Middle East. After all, when Israel attacked Iran in June, gold prices barely budged. If a stock does not grow despite favorable circumstances, it is an obvious a sign of market weakness. And an invitation to deeper declines when the external environment will get worse (i.e. worse from the point of view of gold holders. Objectively it would rather be an improvement in the economic and geopolitical situation).

Nothing grows forever. Not in a straight line.At the peak of this year's (YTD) dollar rate of return from gold was an impressive 33.7%. At the moment it is +27.2%. So also better than not bad and practically as much as gold earned in the whole of 2024 year. But let's be honest: in the long run it is not possible to to maintain the "barbarian relic" gains of 20-30% per year. And at least without hyperinflation in the United States and the collapse of the dollar.

All you need to do is make some simple calculations: with a constant 25 percent annual appreciation, gold in 2030 would cost $10,205 an ounce. Even the biggest "gold buddies" from Incrementum do not assume such levels, who in May maintained their "base" forecast of 4,080 USD/oz. in the perspective this decade . Even in the "inflationary" scenario: they do not expect more than 9,000 USD/oz.

Hence, a more or less shallow correction in my opinion. gold simply deserves it. I don't know if it will be a quick 20% drop or long-term sideways trend allowing for "cooling of oscillators". But it is difficult gold should be expected to "add" another 27% in the second half of the year. Let me remind you only that the geometric average annual rate of return on gold (in USD) for the last 55 years is 8.1% (and 10.5% for the previous 25 years).

What fueled the gold bull market?Over the last quarters, one of the main driving forces gold price increases were central bank purchases. According to Metals Focus estimates world monetary authorities are on track to purchase money for the fourth year in a row 1000 tons of gold . Slowly but steadily, to treasury is added by the People's Bank of China . But the leader in accumulating "barbaric relic" was the National Bank of Poland, which until end of May increased gold reserves by 67.2 tonnes .

In this way, the NBP has more than achieved the goal of the president Glapiński, assuming that 20% of all currency reserves would be invested in gold. Thanks ago National The Polish Bank already has more gold than the European Central Bank . But This also means that Poland's gold reserve accumulation program may have already come to an end. the end. And consequently, the fall from the market's largest institutional buyer . Also other central banks may slightly reduce gold purchases, although they are unlikely to change their long-term stance policies in this area. Especially since Donald Trump has just proven that keeping all your assets in the United States is not a good idea idea.

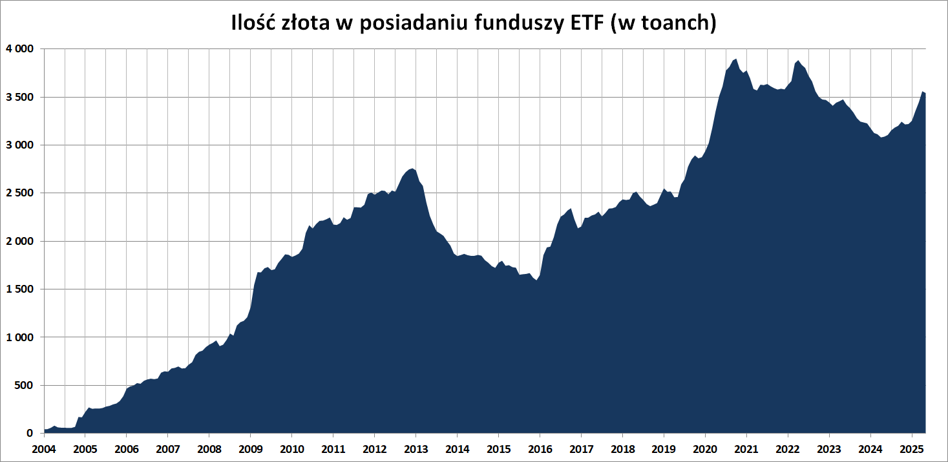

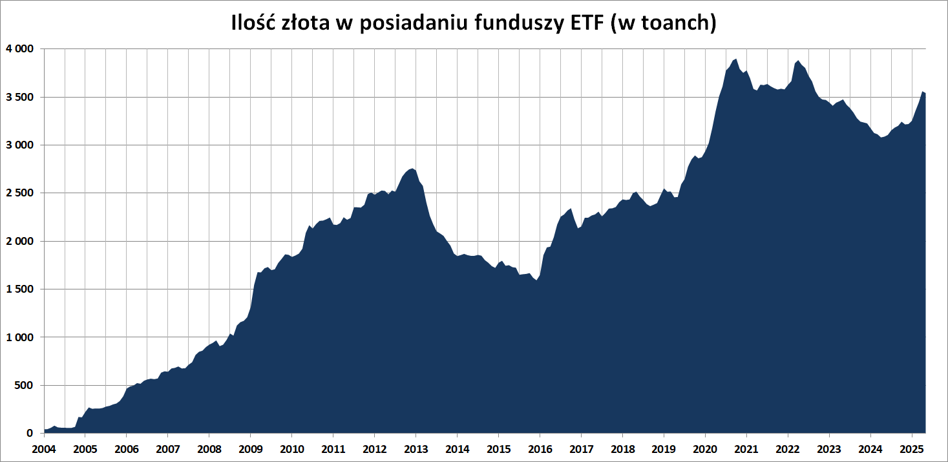

The second engine of the gold bull market "fired" only in January. There were it is the inflow of cash into ETF funds, which buy the yellow with investors' money metal. In February, ETFs bought one hundred tons, in March they added 92 tons, and in April as much as 115 tons. But already in May they got rid of almost 20 tons of the ore, returning to purchases in June (46.3 tonnes for the first three weeks of the previous month). Here everything depends on the "sentiment" of investors (especially institutional ones), who tried to chase the gold train in the previous months and catch up place in the fast express train. When it stops a bit (or changes direction), the group of passengers may thin out. This is a factor that is difficult to predict. It is worth noting, however, that there is still less gold accumulated in ETFs than took place in the peak moments of 2020-2021. In this perspective, demand rather has not run out.

Let's add short-term speculators to the puzzle, operating using New York futures contracts. According to CFTC data it appears that the speculative position in gold contracts amounted to 200.6 thousand. contracts. This is significantly less than at the end of March, when it reached almost 300 thousand. contracts. However, this is still a large overhang of potential supply of "paper gold" and these are definitely not values that indicate the market is oversold.

Beyond the dollar, the correction looks more impressiveIt is worth returning to the currency issue for a moment. I mentioned that since April, gold prices in dollar terms have not been rising, even though the dollar itself is growing quite dynamically is losing against other major currencies. As a result, gold prices in European currencies have fallen much more than those expressed in USD. For example, in euros, the yellow metal is quoted at 6.4% below April peak (while in USD it is -4.5%). Prices expressed in Swiss francs have also fallen by 6.4% from their peak.

For us, however, the most important thing is the rates expressed in Polish zloty. currency. On July 2, the "stock exchange" price of a troy ounce of gold was approximately 12,080 PLN. This is almost 7% less than the spring record, which was at an altitude of almost 13,000 zlotys per ounce. And on Friday there was a "promotion" on gold even deeper and reached almost 1,200 PLN/oz.

No matter how long the gold market correction lasts or how deep it turns out to be, it does not change my conviction that the royal the metal is in a long-term and strong upward trend. This trend He hasn't shown us his full potential yet and I assume he will do so more or less until the end of the current decade. With this assumption, I treat the position in physical gold as a kind of security and additional diversification of the long-term investment portfolio . Remember, that we do not come for gold to make money on it. Gold is an asset of last resort that will remain when all others fail.

bankier.pl