Is the public-private partnership market already in recovery? There is an up-to-date report

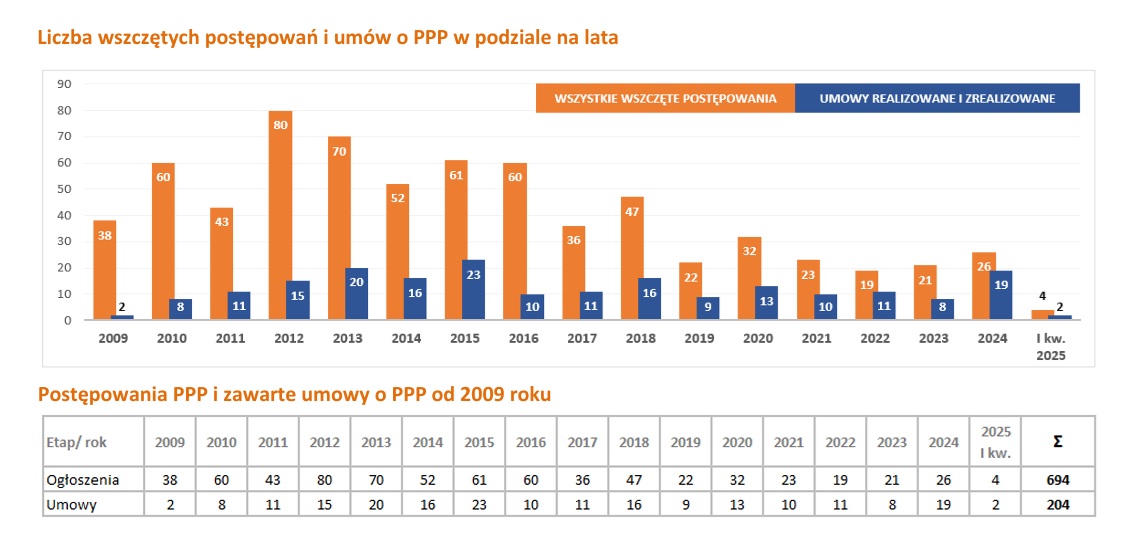

- As of March 31, 2025, a total of 204 PPP agreements were concluded in Poland (ongoing and completed), and the number of announced proceedings was 694.

- In 2024, the negative trend that had been ongoing since the pandemic was interrupted, as 19 contracts worth nearly PLN 557 million were signed at that time. Unfortunately, data for Q1 2025 show that there has been no continuation of last year's positive trend so far.

- The President of the PPP Center Foundation, Bartosz Mysiorski, believes that the Polish PPP market is not developing sufficiently and has even come to a standstill. He sees the solution in, among other things, greater government involvement in the implementation of partnership projects. - This would encourage other public entities to consider the PPP formula more widely.

The quarterly report prepared by the entity supervising the PPP market in Poland, i.e. the Ministry of Funds and Regional Policy , covers projects implemented on the basis of three acts :

- on public-private partnership,

- on a concession agreement for construction works or services,

- on energy efficiency.

“Therefore, for example, the report does not include projects implemented under the Toll Motorways Act and financed from the National Road Fund,” the ministry noted.

He also noted that as part of this update , a change was made in the amount range for small projects, i.e. the maximum value was increased from PLN 40 to PLN 50 million, which results from the need to unify the approach with the PPP Guidelines, in which the lower threshold of the value of a large project was set at PLN 50 million.

After a weak 2023, there was one of the best periods in the history of Polish PPP- In recent years, i.e. during the pandemic, rising inflation and unpredictable geopolitical situation, a decrease in the number of concluded PPP agreements has been observed. While in the period 2010-2019 an average of about 15 PPP agreements were concluded annually, in the years 2020-2023 an average of 10 PPP agreements were concluded annually, and even fewer - in 2023 only 8 were recorded - MFiPR pointed out.

In 2024, however, this negative trend was interrupted. A total of 19 agreements worth almost PLN 557 million were concluded, which is almost 5 per quarter. Since Poland has introduced regulations regulating the market in detail, i.e. since 2009, only 2015 and 2013 were better in this respect.

Unfortunately, the data for the first quarter of 2025 show that there is no continuation of last year's positive trend so far.

Two contracts for PLN 6.2 million. "The number remains slightly below the trend line"In the period from the beginning of January to the end of March this year, only 2 contracts were signed with a total value of PLN 6.2 million .

1. Provision of collective water supply services in the Ozorków commune ( PLN 6.1 million , Łódź Province, contract concluded on February 2, 2025 by the commune office),

2. Provision of a service consisting in the acquisition, management and processing into useful forms of electricity, biogas generated at a landfill for waste other than hazardous and neutral waste in Sobuczyn ( PLN 103,000 , Silesian Voivodeship, contract concluded on March 26, 2025 by Częstochowa Municipal Enterprise ).

- A similar number of concluded contracts was also recorded in Q1 2021, 2022 and 2023 , while in Q1 2024 there were 4 contracts . The number of concluded contracts still remains slightly below the trend line - the ministry indicated.

In the period 2009-Q1 2025, a total of 204 PPP agreements were concluded in Poland (implemented and completed).

PPP is still being developed in our country mainly by local governments, which have so far concluded (directly or through entities related to them) 187 agreements , which constitutes 92 percent of all agreements. And these are still mainly small projects, currently up to PLN 50 million, and previously up to PLN 40 million.

Four new proceedings with a total value of PLN 26.6 million. We are approaching 700 since 2009.As calculated by MFiPR, in the first quarter of this year, 4 proceedings were announced with a total value of PLN 26.6 million . Of these, 2 proceedings concern projects from the energy efficiency sector, the next ones from the health care and telecommunications sectors. Compared to data from the first quarter of 2024, we have a decrease of 2 proceedings.

In quantitative terms, the following sectors dominate:

- water and sewage management (32) ,

- energy efficiency (30) ,

- sports and tourism (29 agreements) .

In the years 2009-2025, 694 PPP proceedings were initiated . Considering the period from 2017, the effectiveness of these proceedings measured by the ratio of signed agreements to initiated proceedings remains at the level of 43% . This is significantly more than in the period 2009-2017, when this indicator was 23% .

2-3 contracts in one direction or the other are not a breakthrough. "The private market is waiting for these projects"According to Bartosz Mysiorski, president of the PPP Center Foundation, there is still no breakthrough in the Polish PPP market, although taking into account the large investment needs and the still not very good financial situation of public entities, including local governments, partnership may be one of the solutions.

The expert reminded us that this is a tool that would help increase the efficiency of the public service delivery process, i.e., allow public entities to gain access to private capital and experience and implement projects on time and according to plan. But only some decide to use it.

The main reason for this state of affairs is still the lack of knowledge about the PPP formula and the fear of a complicated process.

- he stated.

According to Bartosz Mysiorski, public entities prefer to use subsidies because it is easier for them and they know the process well, whereas in the case of PPP, you need an idea, greater commitment and persistence to achieve the goal. So it is not a formula for everyone.