New cashless record. Can you guess which country?

The lowest ever share of cash in consumer transactions, the decline in the value of paper money in circulation – such records were set by the central bank of one of the countries. This is the place where the slogan of society without cash is very close to reality.

The Norwegian central bank published a report presenting development of the payment system in 2024. This document is worth attention for at least for one reason – Norway has been among the top countries in which cashless payments dominate. However, it seemed that the trend of moving away from cash money has its natural limits. The latest data seem to deny.

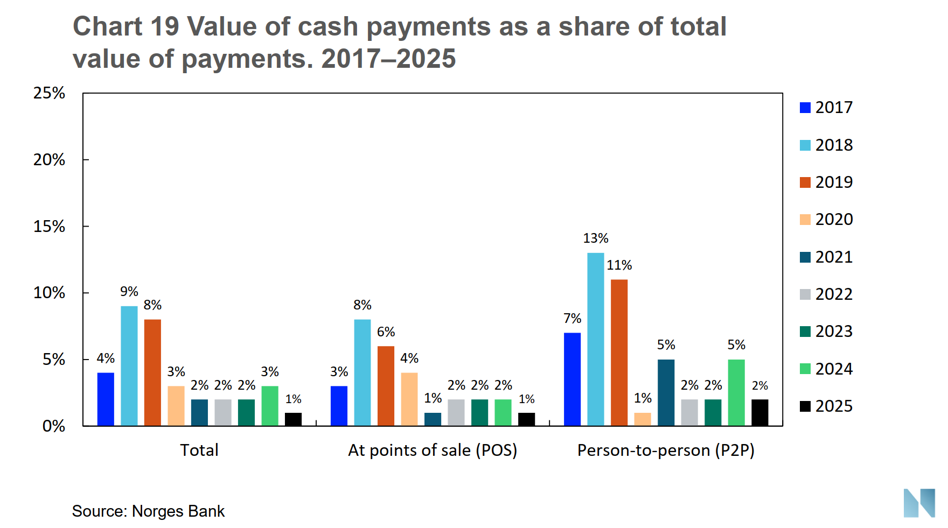

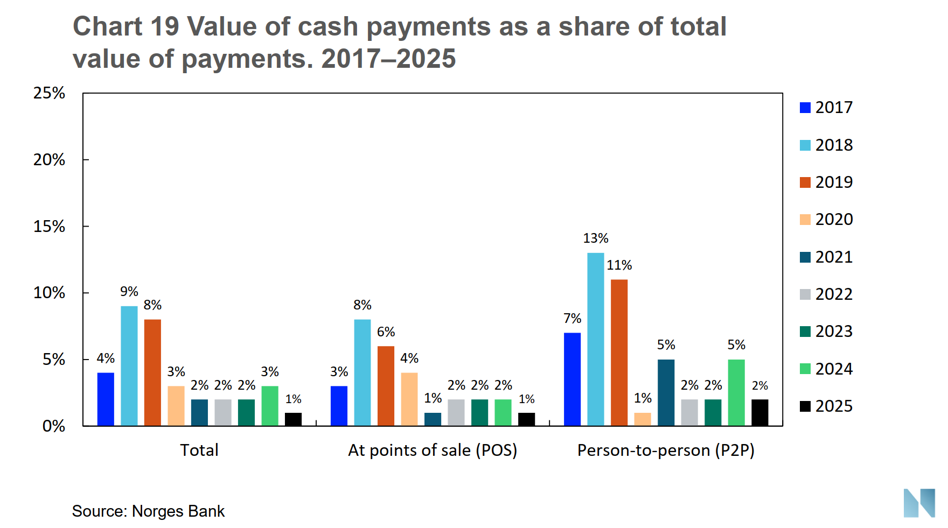

If we look at the data from Norway, it was clear up to this point two stages of change . By 2020, the share of cash in payments retail was decreasing. In 2018, paper money accounted for 9% percent of transactions by value and 12 percent by quantity.

After 2020, the indicators stabilized at a very low level. level . Cash accounted for 2-3 percent of transactions for several years in value and 3-4 percent in quantity. It was possible to put forward a hypothesis, also looking at on the data from other largely cashless economies (such as Sweden or Iceland) that these values are minimums below which it is impossible to go without complete, top-down abandonment of paper money.

According to the latest data from Norges Bank, which is based similarly to In previous years, the research on the payment behaviour of households has revealed However, a different picture emerged. The share of cash decreased again after a break of several years, reaching historic lows . Money in this form is responsible for only 1 percent of value and 2 percent of number of payments .

Hard indicators show the same trendThe decreasing importance of cash in Norway is indicated not only by household sample survey data. To record lows fell in 2024:

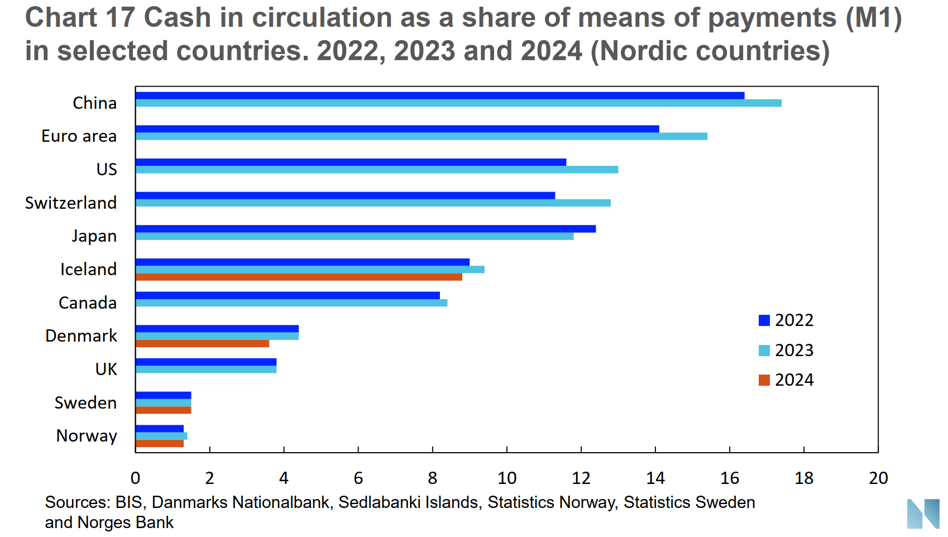

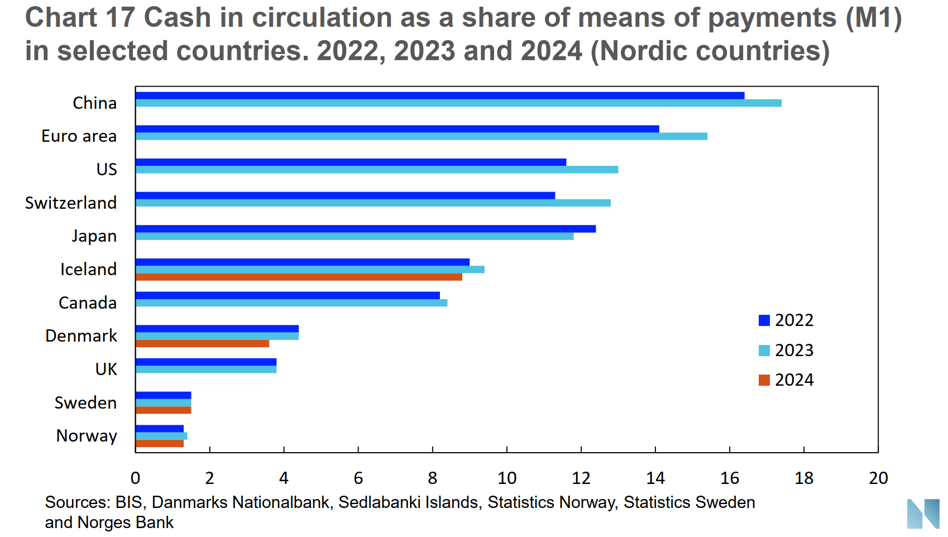

- The share of cash in the M1 aggregate (measuring the supply so-called transaction money, i.e. in a form that is directly usable in payments) – 1.3 percent (2.7 percent in 2015).

- The ratio of the value of cash in circulation to GDP – 0.9 percent (1.9 percent in 2015).

- The value of cash in circulation outside bank vaults – below NOK 36 billion in November 2024

- Number and value of cash withdrawals from ATMs (12.9 million operations in 2024 vs. 15.7 million a year earlier).

- Number and value of payments per ATM per year (1,129 ATMs in the country, which is a new minimum, handle an average of 11.3 thousand payments per year, down from 13.4 thousand in 2023).

In international comparisons presented by Norges Bank Norway is in a completely different league than some of the countries Scandinavian countries. For example, the share of cash in M1 is more than twice as high in Denmark and more than four times higher in Iceland. In the eurozone, by comparison, reaches 16 percent

The closest we get to the records held by Norway is Sweden. Data presented by the Riksbank show that in 2023 only Every tenth consumer paid for their last purchase in a store with cash.

Scandinavian countries do not intend to, despite the observations trends, part with cash for now. In Sweden and Norway last year regulations have been introduced specifying the obligation to accept money in this form. This year, however, work began on strengthening resilience of the payment system to disruptions in access to communications .

bankier.pl