The US economy has recovered after a weak start to the year. GDP is back in the black.

After one weak quarter, the world's largest economy recorded growth again solid growth. However, the structure of the United States' gross domestic product remains remained distorted by the impact of President Trump's tariff wars.

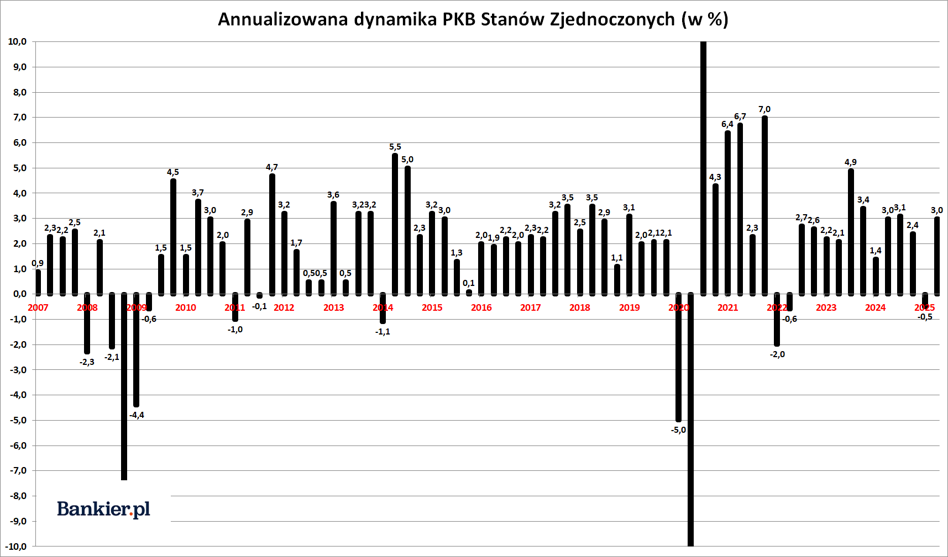

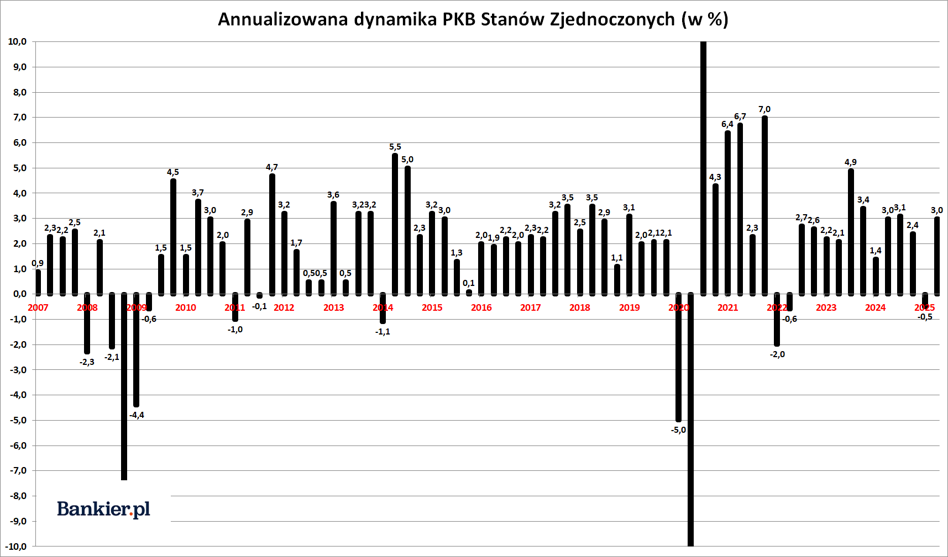

In the second quarter of 2025, the gross domestic product of the United States The United States recorded a 3.0% increase in annualized approach – according to preliminary estimates published by the government's Bureau of Economic Analysis (BEA). A quarter earlier the world's largest economy contracted at an annualized rate of 0.5% .

This was a result that clearly exceeded the expectations of economists increase by 2.4%. But the model The Atlanta Fed assumed that the annualized growth of the United States' GDP in In the second quarter, it will reach 2.9%. This time, the model proved better than the people.

It should be noted here that the Americans present the dynamics GDP differently than Europeans - they annualize short-term data, i.e. convert them into year-round values. In short, the monthly value is multiplied 12 times, and the quarterly rate 4 times. We wrote more about this in text "What is annualized GDP? We explain."

AdvertisementIf we counted "in European terms" we would write that the American GDP recorded an increase of 0.73% compared to the previous quarter and was almost 2.0% higher than in the second quarter of 2024.

Data distorted by customs dutiesWe also have to take into account the fact that these were two very unusual quarters for the world's largest economy. Since the end of last year American business was preparing for the entry into force of high tariffs imports imposed by President Trump's administration. As a result, in I quarter saw increased imports, which reduced GDP growth. At the same time, in stocks were growing at a crazy pace.

However, in the previous quarter, BEA statisticians recorded over 30% annualized decline in import value after 37.9% increase in first three months of 2025. At the same time, investment demand (comprising which also includes the change in inventories) shrank at an annualized rate of 15.6% after a 23.8% jump in the previous quarter. Consumption was much more stable, which grew at a rate of 1.4% after a 0.5% increase in the previous quarter. In both cases, however, these results were significantly weaker than in the previous few quarters.

For the second quarter in a row, the composition was also very unusual of US GDP. Private consumption added 0.98 percentage points to the annualized GDP growth (compared to 0.31 percentage points a quarter earlier). Net exports added almost five percentage points after it subtracted 4.6 percentage points in Q1. Change in inventories subtracted 3.2 percentage points after as in the first quarter it contributed as much as 2.6 percentage points. Corporate investments added less than 0.1 percentage point, while public spending added another 0.1 percentage point.

GDP deflator - the broadest measure of prices in the economy, covering not only consumption, but also the prices of investment goods, industrial or construction – decreased in the second quarter to 2.0% compared to 3.8% recorded a quarter earlier. This was a lower-than-expected result. by economists 2.2%. But the base deflation of consumer spending (PCE) core) recorded in the entire quarter annualized growth of 2.5% compared to the expected 2.3% (and 3.5% in Q1).

bankier.pl