Fed Doesn't Bow to Trump: No Rate Cuts Again

Federal Reserve management did not bow to pressure President Donald Trump and again did not lower interest rates despite insistence of the head of state. The "pause" in the interest rate cuts cycle has lasted for half year.

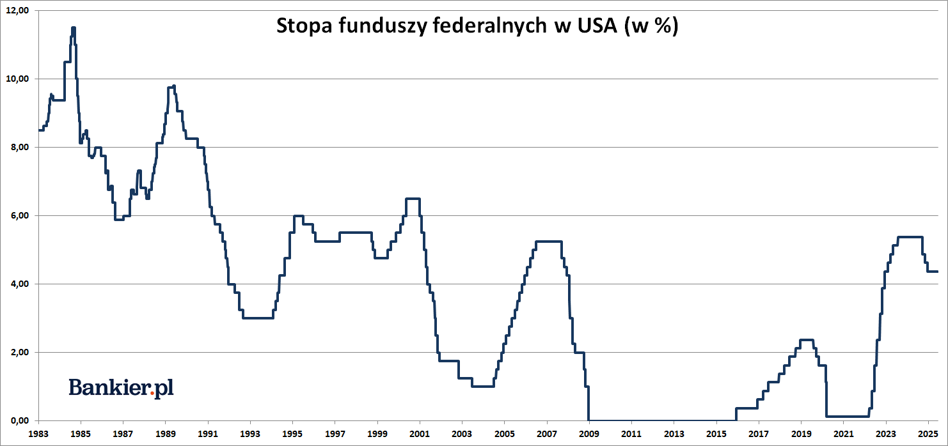

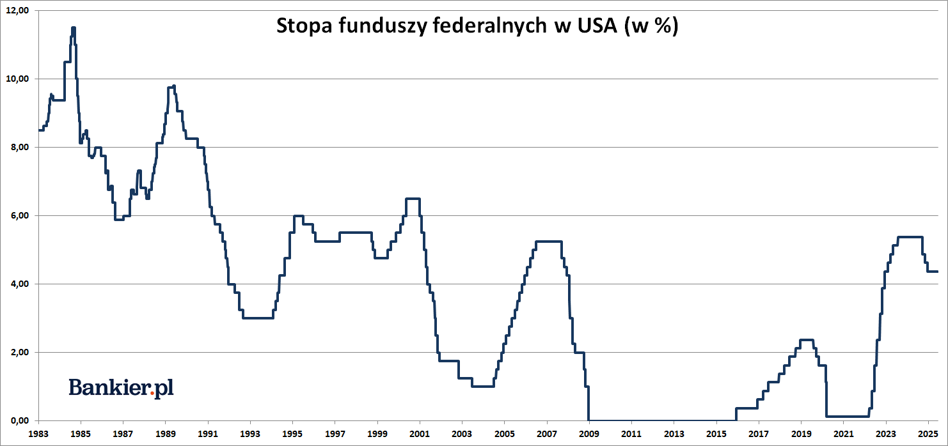

The federal funds rate range remained unchanged at 4.25-4.50% - the Federal Open Market Committee (FOMC) announced in a statement. The June decision was passed unanimously and was in line with the expectations of economists and participants market.

After the previous such decision on the management of the Reserve The federal government has been hit with a wave of criticism from President Donald Trump. - Jerome Powell is an idiot who has no idea about anything (…)He is still late, but that it doesn't matter much because our country is strong - yes The host of the White House commented on the May FOMC decision . President Trump had already demanded that the Fed further cut interest rates to reduce costs servicing the gigantic US public debt .

- The Committee is sensitive to risks for both sides of its a double mandate – a much milder and reduced version of May's warning against the influence of politics President Trump's tariffs on the US economy – Uncertainty regarding the economic outlook has decreased slightly but is still elevated – the Committee stated.

It has already been half a year of the "post-election" pause in monetary easingIt's been half a year since the last interest rate cut in United States central bank. The monetary easing cycle has begun in September 2024, nervous and a substantively unjustified cut of 50 bp at once . This move Chairman Powell explained "recalibration" rather vaguely monetary policy . More cuts in the federal funds rate – this time 25 basis points each – took place in October and November. The total scale last year's cuts amounted to 100 basis points. After the presidential election, the Fed he no longer lowered his feet.

- We don't have to hurry and we are well prepared, to wait for more clarity (on the Trump administration's policies – (editor's note) – he said On March 7, the head of the US central bank.

In addition, in March the FOMC did not change the level of interest rates, but decided to limit "quantitative tightening" (QT) of monetary policy. Starting in April The Federal Reserve has reduced the pace of reducing its balance sheet from $60 billion to USD 40 billion per month. This is a limitation of "quantitative tightening" in a certain to this extent was the easing of monetary policy in the USA.

Next cut only after the holidays?In recent weeks, investors have been reducing their expectations for future Fed interest rate cuts. Currently the futures market estimates a 68% chance of at least a 25 basis point cut The federal funds rate will be reached at the September meeting at the latest FOMC – according to FedWatch Tool calculations. At the beginning of May, it was still 73% the chances of a cut in July were estimated. Now its implied valuation is less than 15% chances.

However, until the end of 2025, interest rate reductions are "in the prices". federal funds by a total of 50 basis points. This is significantly less than the mere six weeks ago, when the futures market was pricing in a cut of 75-100 bps.

- The Committee is strongly committed to supporting the mandate full employment and bring inflation back to the 2 percent target – the Federal Open Market Committee recalled in its May statement.

The next meeting of the Federal Open Market Committee is scheduled for July 29-30.

bankier.pl