Investors underweight the dollar. The zloty is stable after Trump's tweets

Donald Trump's posts on the exchange of fire in the Middle East are a bit spooked the markets, causing the dollar to appreciate and oil prices to jump again. The night did not bring the solstice, however, and Wednesday morning brings a correction. The golden is holding steady against the euro, but much will depend on the market's reaction to the Fed's decision and communication on interest rates and the direction in which the conflict between Israel and Iran will develop. Meanwhile, the dollar is proving to be the most underweight asset in fund managers' portfolios.

US President Donald Trump on Tuesday wrote in a number of plural, that "they have complete control over Iranian airspace". "UNCONDITIONAL CAPITULATING!" the president wrote in another post. What sparked speculation about the active involvement of the United States in the conflict, especially since German Chancellor Friedrich Merz said that the United States The United States is reportedly considering taking part in attacks on Iran. This has increased aversion to risk on the markets. Oil gained over 4 percent. The dollar strengthened, but only slightly gold prices rose.

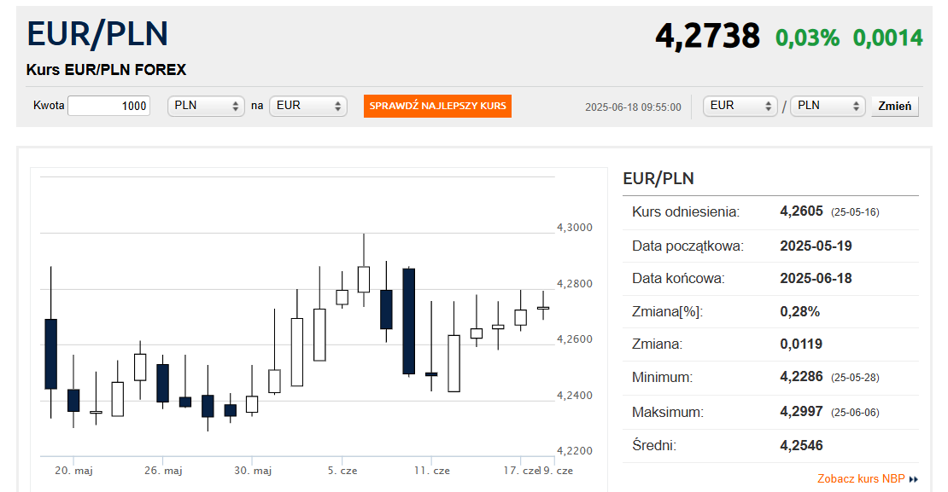

The EUR/PLN exchange rate remained stable and even resistant to events of the last few hours . On Wednesday morning just before 10:00 a.m. for the euro 4.2738 PLN was paid, which is almost the same as the daily amount earlier this time. On Tuesday, despite the weaker sentiment towards risky assets (falls on stock markets) EUR/PLN failed to break the level of PLN 4.28.

"The beginning of trade in Europe does not bring any major movements on EUR/PLN. Apart from extreme scenarios related to the situation in the Middle East In the East, we expect another day of stabilization of the national currency and valuation euro in the range of PLN 4.26-4.28" - BGK wrote in the report.

"On Wednesday, it's the development of the situation in the Middle East, and macroeconomics, the FOMC meeting, will be the main factors influencing the market moods. The further course of the conflict between Israel and Iran is difficult to predict forecast, there is little indication that it will end soon, looking at on the upward trend in crude oil prices," the report reads PKO BP.

"This could lead to an increase in the dollar's function as a safe haven and its appreciation. In the case of EUR/PLN we assume continuation of the sideways trend, with a persistent risk of an attack on its upper part restrictions (4.29) if global sentiment were to deteriorate suddenly" - added.

The appreciation of the dollar was indeed correlated with Tuesday's deterioration of market sentiment. The dollar jumped against the zloty on Tuesday afternoon to over 3.72 PLN and was the most expensive in almost a week. In turn, the eurodollar fell below 1.15 for the first time since Friday, but on Wednesday morning the EUR/USD rate was above this level again and amounted to 1.1513. These are still levels close to 3 years last Thursday's highs (1.1627) on this pair, indicating weakness American currency.

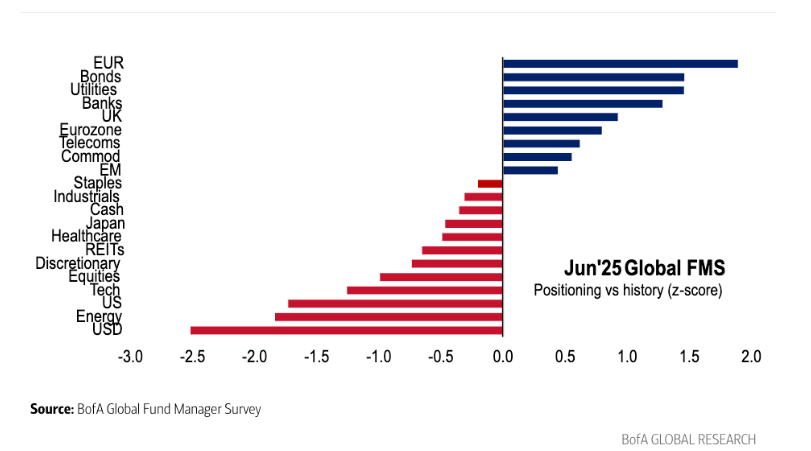

Meanwhile, according to a survey conducted by the Bank of America, global investment fund managers are currently the most underweight in the US dollar. A survey conducted in June in which 206 respondents managing the total value of assets took part amounting to $640 billion, showed that the net position of investors in the dollar fell to its lowest level since 2004.

"Compared to historical data, investors have overweight in euros, bonds and utilities, and underweight in the US dollar, energy and US stocks," he notes Bank of America.

The franc cost 4.5443 PLN and was down about 2 groszy from Tuesday's maximum. The Helvetian currency remains almost record-high against the US dollar, close to almost 14-year highs, but its quotations against the euro remain at significantly weaker levels than three months ago. The British pound was paid for on Wednesday morning at 4.9962 PLN. Inflation data for May appeared in the morning, which amounted to 3.4% y/y, compared to the forecast of 3.3% and the previous reading of 3.5%.

MK

bankier.pl