Oracle Leads Wall Street Growth, S&P500 Closes at Highest Price Since February

Thursday's session on Wall Street ended with slight increases in the main indices, with the leader of the gains being the technology company Oracle. Investors were pleased with the latest data from the US economy. However, uncertainty related to US tariff policy continues to cast a shadow.

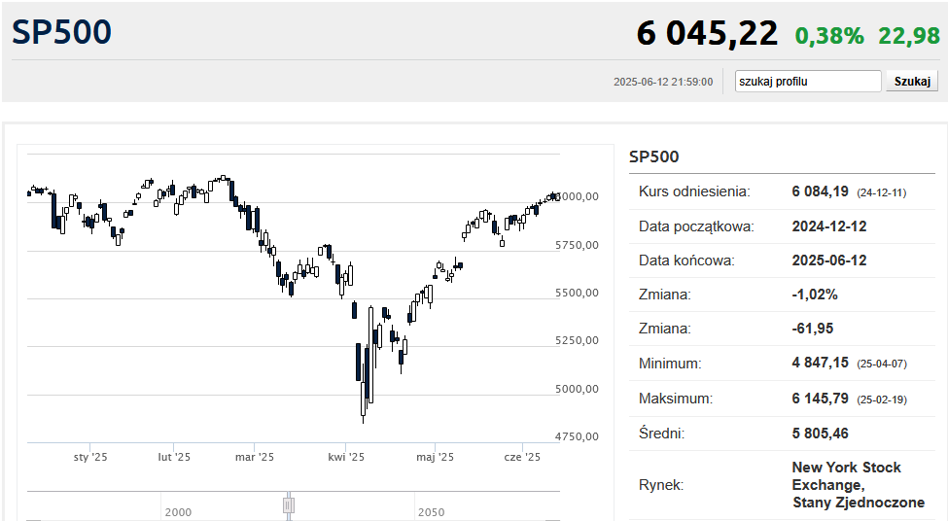

The Dow Jones Industrial Average closed up 0.24 percent at 42,967.62 points. The S&P 500 was up 0.38 percent at 6,045.26 points, its highest closing price since February 20. The Nasdaq Composite was up 0.24 percent at 19,662.49 points. The Russell 2000 mid-cap index was down 0.42 percent at 2,139.25 points. The VIX index was up 4.40 percent at 18.02 points.

Oracle shares rose 13% after the company reported fiscal fourth-quarter results that beat analysts’ expectations on both profit and revenue. Oracle Chief Executive Safra Catz said on a conference call that AI demand is expected to drive cloud infrastructure revenues more than 70% in fiscal 2026, up from 52% in the quarter.

Oracle's rally lifted shares of other big technology companies, and the sector led the S&P 500's gains on Thursday.

On the other hand, Dow-component Boeing fell nearly 5% after an Air India Dreamliner 787 crashed shortly after takeoff with 242 passengers on board.

Wall Street is waiting for further developments in trade policy, especially between the U.S. and China, as talks between the two countries have been a focal point this week. President Donald Trump said Wednesday that he would be willing to extend a July 8 deadline for concluding trade talks with countries before higher U.S. tariffs take effect, but that such extensions may not be necessary.

"I would, but I don't think we'll have to. We've got a great deal with China," Trump told reporters. "We're dealing with Japan, we're dealing with South Korea. We're dealing with a lot of them. So we'll be sending letters, in about a week and a half, two weeks, to countries, letting them know what the deal is, just like I did with the EU," the US president added.

U.S. and Chinese officials reached a framework for future talks in London after two days of discussions this week, but the vague outline of the deal still awaits approval by Trump and Chinese President Xi Jinping. The two countries agreed to ease some restrictions on rare earth metals and foreign students.

“We continue to believe that the primary driver for market direction and a breakout to record levels will be a resolution of tariffs and their link to the budget and the Fed. We see a lot of headlines about negotiations, pauses or frameworks, but we still haven’t seen a single signed trade deal between the U.S. and its trading partners,” said Tom Hainlin, senior investment strategist at U.S. Bank Asset Management Group.

"We still see that we are in our base case of uncertainty about how the trade negotiations are going. The market has some range to move, but it really lacks a sustained breakout until we get to some kind of conclusion," he added.

Stocks also rose during Thursday's session after investors received another portion of data indicating the solid state of the U.S. economy.

The number of people seeking initial unemployment benefits in the U.S. last week was 248,000. Economists had expected initial jobless claims to be 242,000, up from 248,000 previously, revised down from 247,000.

The number of unemployed people continuing to collect benefits was 1.956 million in the week ended June 7. Analysts had expected 1.910 million, compared with the previous figure of 1.902 million, revised down from 1.904 million.

The PPI industrial production prices in the US rose by 0.1% month-on-month in May and by 2.6% year-on-year. Excluding food and energy prices, the PPI index rose by 0.1% month-on-month and by 3.0% year-on-year.

Analysts had expected PPI to rise by 0.2% MoM, and excluding food and energy prices, they expected an increase of 0.3% MoM, compared to -0.2% and -0.2%, respectively, a month earlier.

In year-on-year terms, PPI growth of 2.6% and growth of 3.1% for the core indicator were expected, compared to +2.5% and +3.2%, respectively, in the previous month.

WTI crude oil on NYMEX for July delivery is up 0.13 percent to $68.24 per barrel, while Brent on ICE is down 0.14 percent to $69.67 per barrel. (PAP Biznes)

pr/

bankier.pl