US inflation lowest in 4 years. Core indicator still too high

The April reading of the CPI inflation for the United States was was slightly lower than economists' expectations and reached the lowest level for over 4 years. However, the underlying inflation pressure in the US remains too high.

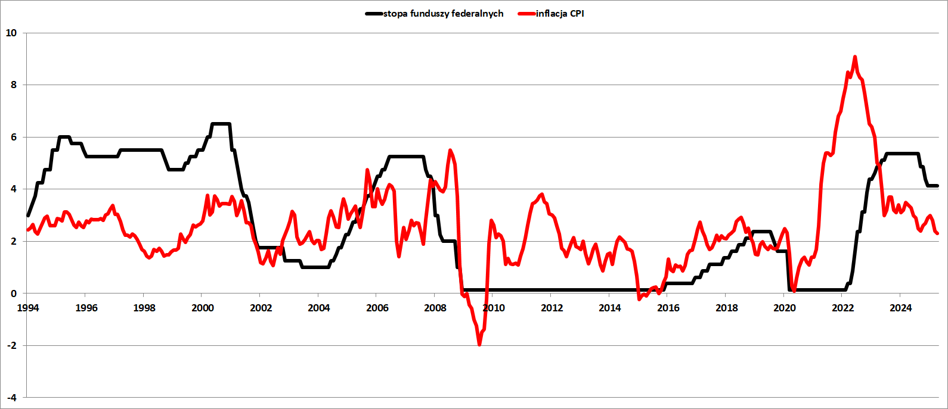

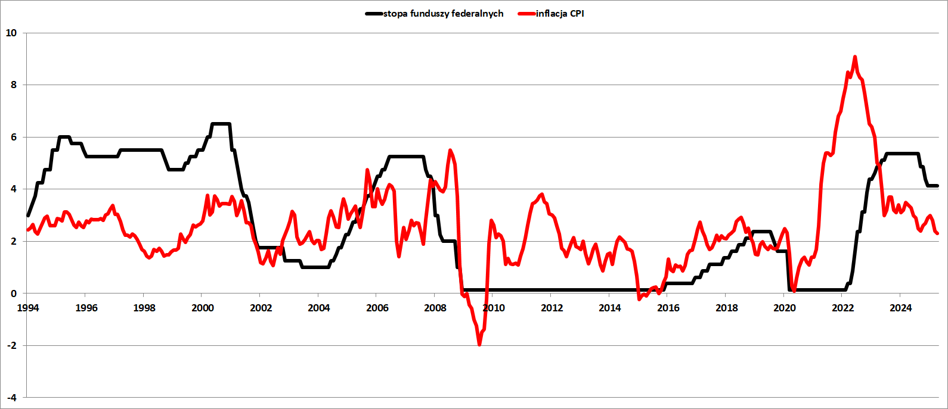

In April 2025, CPI inflation in the US reached 2.3% , the Bureau of Labor Statistics (BLS) reported. It was the 50th month of the row in which CPI inflation exceeded the Federal Reserve's 2 percent target. At the same time, however, it was the lowest US CPI reading since February 2021.

The market consensus was to expect a reading of 2.4%. However, the Cleveland Fed's forecasting model indicated that the April CPI inflation in the US was 2.34% on an annual basis and 0.22% on a monthly basis. Therefore Today's BLS reading was only slightly lower than the market consensus and it is difficult to consider it as any an extraordinary surprise.

Compared to March, the consumer price index rose by 0.2% after falling by 0.05% m/m recorded in March and an increase of 0.2% MoM in February and an increase of as much as 0.5% month-on-month in January. Economists expected CPI to rise by 0.3% Average monthly increase in US CPI for the previous 6 months was 0.25%. If this rate is maintained for the next 12 months, annual inflation The US CPI for the year would be 3.04%, a percentage point above the 2% rate Fed goal.

What's Next for American InflationInflation a month earlier US CPI slowed to 2.4% YoY , hitting lowest level level since September last year. What's more, thanks to the sharp drop in fuel prices BLS recorded the sharpest decline in the consumer price index since July 2022 (down 0.05%). However, in the following months it is possible to accelerate US CPI inflation due to tariffs imposed on goods imported to USA. The only unknown is the scale and timing of the increases. consumer price lists.

Import duties are essentially a tax imposed on consumers, although in a direct sense it is importers who take it away. However, they they pass on the customs duties to the final recipients, which will happen in the near future months will probably lead to an increase in prices not only of goods originating from imports, but also their domestic substitutes.

Core inflation, i.e. the indicator, also remained unchanged. CPI excluding food, fuel and energy. Consumer inflation calculated this way stood at 2.8%, after reaching its lowest value in almost four years in March years. However, these readings are still at odds with the 2 percent target central bank of the United States.

The Cleveland Fed model currently assumes that the price index will rise in May consumer goods (CPI) will increase by only 0.12%. Maintaining such (or lower) monthly dynamics in the following months could lead to CPI inflation to the Federal Reserve's 2 percent target.

At the April meeting of the Federal The Open Market Committee has again decided to maintain interest rates interest rates unchanged . This "pause" in the monetary policy easing cycle started in January. In September, the rate federal funds rate was cut by 50 basis points, and in November and in December there were cuts of 25 basis points each.

bankier.pl